Omnibus Segregated Account (OSA)

The omnibus segregation model allows Clearing Members (CMs) to segregate client positions and collateral (for multiple clients) from the Clearing Member's proprietary positions and collateral.

Eurex Clearing's omnibus segregation models are highly flexible and aim to address the requirements of our members and their clients. The benefits for clients of omnibus segregation include:

- porting

- return of collateral (return segregated from the CM's proprietary business) and

- compliance with EMIR requirements.

Within the omnibus segregation arrangements, position segregation for clients is achieved.

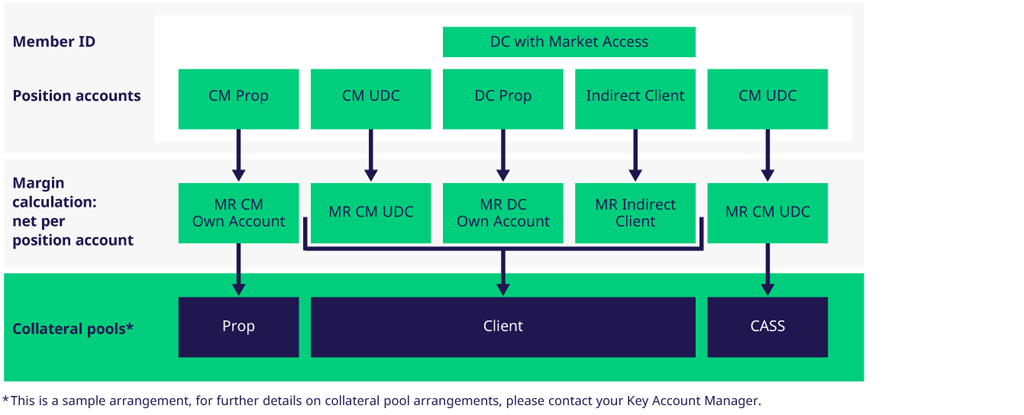

- The Elementary Clearing Model (ECM) is an omnibus client segregation model. It provides for the segregation of proprietary positions and assets of a Clearing Member (ECM proprietary) from its client-related positions and assets (ECM Omnibus/ECM Omnibus CASS).

- Transactions designated as CASS Eligible Transactions are legally segregated from non-CASS Transactions and Eurex Clearing will sign trust acknowledgement letters in order.

To enable UK based Clearing Members to comply with their obligations under the Client Asset Sourcebook (CASS Rules) of the United Kingdom Financial Conduct Authority (FCA) Eurex Clearing will sign trust acknowledgement letters. Dedicated account(s) at the CSD is required.

Position segregation:

- The position account structure within ECM Omnibus/ECM Omnibus CASS supports the segregation of positions of Direct Disclosed Clients from the positions of their (indirect) clients. The accounts maintained in relation to indirect clients are offered as NOSA or GOSA and are linked to the relevant direct client.

- Direct Disclosed Client accounts qualify as GOSA. For DCs with System Access or Basic DCs only Eurex Transactions, OTC Interest Rate Derivatives Transactions and OTC NDF Transactions are eligible for the clearing under OSA.

- For each GOSA a separate position account shall be maintained. GOSA is available for the clearing of Eurex Transactions and OTC Derivatives Transactions reflecting the position of that specific Disclosed Direct Client or Indirect Client of such Disclosed Direct Client. Therefore, margin requirement is calculated on a gross basis for GOSA clients.

- As each NOSA reflects positions of multiple clients the margin requirement calculation is performed on a net basis.

- The CM can optionally select for its OSA client a set-up of multiple transaction accounts in a single risk netting unit and calculate the initial margin requirements across multiple position accounts. Only agent accounts of the same type, i.e. NOSA or GOSA, can be combined into a single risk netting unit. For further information please see Eurex Clearing Circular 031/20.

Asset segregation:

- The assets are provided by the Clearing Member to Eurex Clearing separately for own transactions of the Clearing Member and for client-related transactions of the Clearing Member.

- At least two collateral pools are required. For OSA CASS dedicated account(s) at the CSD is required.

- On request of the Clearing Member, Eurex Clearing will establish additional pools to cover ECM Omnibus Transactions.

- Collateral in an omnibus structure will always be shared across multiple clients and leads to fellow customer risk for any potential shortfall in a collateral pool in case of a Clearing Member default.

- Collateral management options ensure the model is operationally simple to manage at the CCP.

- In Eurex Clearing's view, based on the requirements stipulated by Art 305(3) CRR, a Disclosed Direct Client (under a GOSA-account-setup) is entitled to calculate its own funds requirements with a risk weight of 4% (in connection with Art 306(1)(a) CRR). Any exposure arising from cash Margin and Variation Margin will be considered in the netting arrangement. Pledged securities are not considered in the netting arrangement; securities collateral should generally be eligible for a risk weight of 4% (Art 305(3), 306(1) CRR) or – depending on the bilateral arrangements between the Clearing Member and the client – a 0% risk weight (Art 305(3), 306(2) CRR).