Eurex Clearing Prisma

Eurex Clearing Prisma calculates combined risks across markets and venues cleared by Eurex Clearing for products sharing similar risk characteristics. These calculations occur within customer and proprietary positions according to Liquidation Groups resulting in more accurate risk calculations. This allows us to provide higher capital efficiencies and a stronger risk management framework to our customers.

- Portfolio margining is applied to products within the same Liquidation Group and with the same holding period, e.g. EURO STOXX 50® Index and DAX® Futures. Portfolio margining offers significant margin efficiencies for diversified portfolios.

- Prisma also permits cross margining between products across markets that are part of our fixed income offering. Cross margining allows for offsets between products with different holding periods. We offer cross margining between OTC IRS (5 day holding period) and listed fixed income products (2 day holding period). The reduced risk profile of interest rate hedged portfolios is therefore adequately reflected by lower initial margin requirements.

Advantages for Clearing Members, their customers and the Clearing House

- Capital efficiency: more accurate risk netting effects for listed, and between listed and OTC positions.

- Accuracy: cross-product scenarios enable a consistent way to account for portfolio correlation and diversification effects.

- Robustness: methodology designed to enable stable and lower initial margin requirements.

- Consistency: consistent risk and default management process for listed and OTC products.

- Automation: automated processes for faster time-to-market.

- Alignment: margining method and default management process are closely aligned.

Risk model

The Eurex Clearing Prisma methodology is based on the view of each member’s entire portfolio and has the advantage to account for hedging and cross-correlation effects through determining the margin requirement on a portfolio level as opposed to a product-by-product view. The elements in the concept are selected so that risk calculation is accurate and stable, ensuring that the concept withstands new shocks and changes to the financial markets and flexibly adapts to changes in the risk environment.

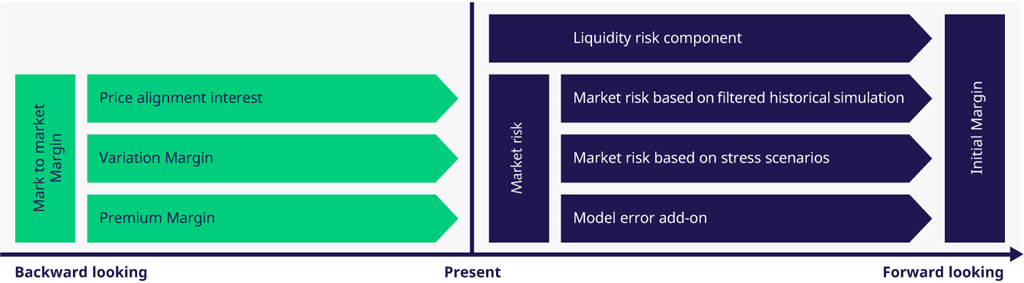

The new risk management approach integrates two kinds of margin components: a backward looking and an improved forward looking margin component.

Eurex Clearing Prisma permits cross margining between products as well as across markets cleared by Eurex Clearing. In particular, this is applied to interest rate derivatives cleared by Eurex Clearing, where cross margining concerns the allocation of positions of listed fixed income derivatives and OTC IRS derivatives in the same Liquidation Group, considering the sensitivities of the products to the general level of interest rates. This ensures that the reduced risk profile of interest rate hedged portfolios is adequately reflected by lower initial margin requirements.

Prisma Releases

Find release dates and further information on our Prisma Release Support page.