Key benefits

- Deep clearing liquidity pools

- Cross-product margining along the complete Euro yield curve without any maturity constraints, allowing for up to 70% initial margin savings

- Full IRD product coverage, including FRA, IRS, Basis and OIS

- Full suite of listed interest rate derivatives, both short-term and long-term, including Euro-EU Bond Futures, Credit Index Futures, futures on the Euro STR, futures and options on the EURIBOR as well as on the German Bund, Bobl, Schatz and Buxl

- Higher capital efficiencies: greater netting effects between listed and OTC positions

- Single cross-product collateral management solution

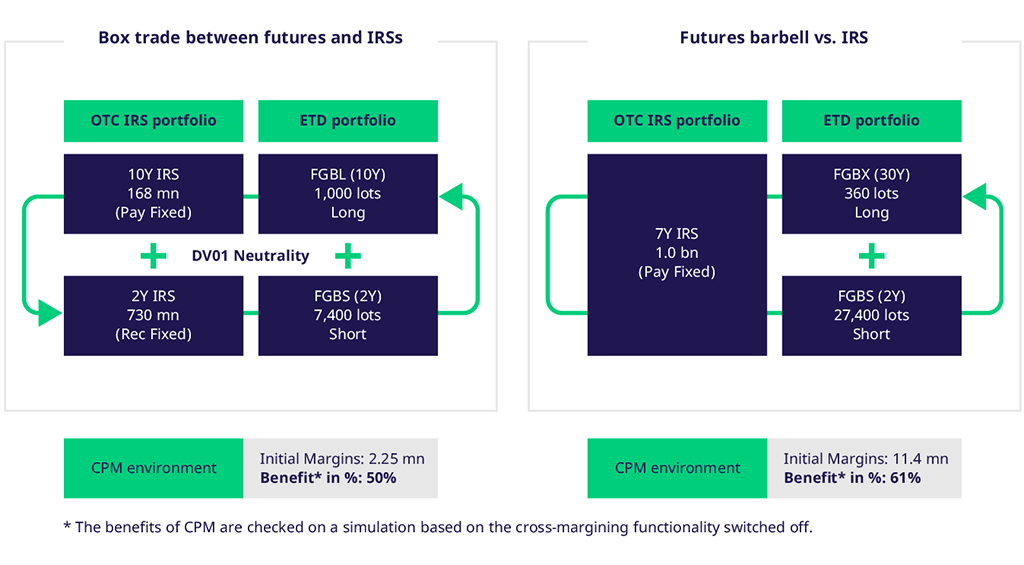

Calculation example

With PRISMA release 10.2, we refined our cross-product margining (CPM) algorithm to better capture the offsetting relationship of holding long and short positions in correlated fixed income asset classes. The examples below show that the strategies applied on the OTC IRS side and the fixed income listed futures side are always offsetting in DV01 terms. The enhancements allow our algorithm to recognize the DV01-neutrality of these structured trades and calculate an amount of initial margin reflective of the reduced risk embedded in the offsetting nature of these trades. These capital charges reductions are not exclusive to such structured trades but are also seen in real-life portfolios of hundreds of long and short positions across OTC swaps and listed fixed income futures.

Margin calculators

Prisma Margin calculators

At Eurex Clearing, we understand that sophisticated margin replication and simulation is essential for our members and their clients. To this end, we offer several tools to calculate and simulate margin requirements within the Eurex Clearing Prisma framework, with each tool designed for a different use case:

The Prisma Online Margin Calculator is a browser-based tool for members, running on Eurex Clearing’s production and simulation environments.

The Cloud Prisma Margin Estimator (Cloud PME) is a cloud-based calculator accessible by GUI and API.

Our margin calculators can be used intraday via API to indicate the potential savings from clearing both fixed income listed and OTC derivatives at Eurex.