Margining process

Our margining process is a multifaceted and time critical process that takes into account a variety of factors in order to calculate margins that adequately protect you, the Clearing Member, your customers, the Clearing House and therefore the marketplace as a whole. We do this while simultaneously setting appropriate levels that do not tie up excess capital.

What is a margin?

Margin is defined as the funds or securities which must be deposited by Clearing Members as collateral for a given position. Margining encompasses the entire process of measuring, calculating and administering the collateral that must be put up for coverage of open positions. The provision of collateral is intended to ensure that all financial commitments related to the open positions of a Clearing Member can be offset within a very short period of time.

Members can satisfy margin requirements by depositing securities or cash. Variation margin (i.e. daily settlement of profits and losses) as well as premiums on traditional options and futures on options must be paid in cash.

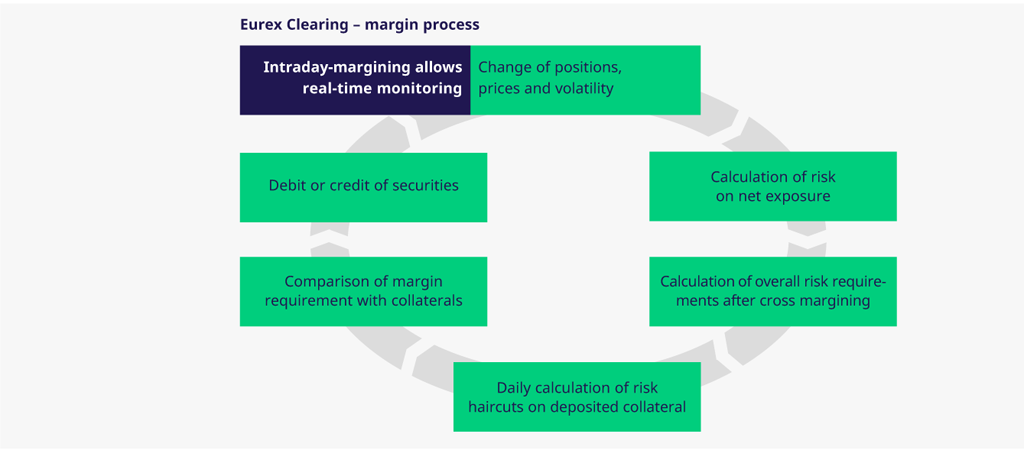

Modern risk management methods need to cope with the advances in trading speeds and changing market characteristics. For that reason, Eurex Clearing calculates real-time the margin requirements for derivatives products by any position or price change. Margin information for equity and fixed income cash products are provided every ten minutes.

Eurex Clearing has established an industry leading intra-day margining process to safeguard and strengthen the lines of defense of the clearing house ensuring the continued integrity of the markets cleared by Eurex.

Lines of defense

Every well-built house starts with a strong foundation. In the case of our Clearing House we have built it on a sound framework of safeguards — which we call our lines of defense — to protect our customers and to enhance the market integrity.

Intra-day margining is an important feature of our risk management framework as it directly reduces the counterparty credit risk of the CCP. The intra-day margin call allows us to quickly respond to increased price volatility or the growing positions of members which in turn allows us to take action to lower the exposure to the CCP. The intra-day margin call also allows us to take into account day trading clients.

The benefits to Eurex Clearing of the intra-day margin call are clear. How does it help you?

Intra-day margining gives you important value added services – especially in the direct market access and algorithmic trading environment by giving you permanent risk assessments of your positions and the positions of your clients' exposure based on current market conditions during the trading day.

Features include:

- Real-time position updates

- Real-time price update

- Real-time intra-day risk evaluation for positions using current underlying prices/volatilities

- Information to allow forecasts of overnight requirements for cash and collateral management

- Risk reports that are delivered with an approximate time interval of ten minutes

- The possibility to break down margin requirements on customer and margin class level

Investors benefit when they only need to cover the risk of their account positions instead of paying the full contract value. The required Collateral is based on the total risk exposure of the account, which includes the price risk of derivatives and cash positions. This calculation considers the risk-reducing effect of offsetting positions, where equal but opposite risks are balanced against each other. This approach ensures optimal security with minimal Collateral required from the market participant.

There are various types of Margins. Premium-, Current Liquidating-, and Variation Margins address the immediate liquidation risk. Additional Margins cover potential liquidation risks for the upcoming business days. Margins are calculated throughout the day, and the Clearing House can directly debit Clearing Members if needed (Intraday Margin Call).

CLM | AM | |||

Volatility-based | Bond Model | Manual Override | ||

Equity | ||||

ETF | ||||

Bonds, Special Repos | ||||

GC Pooling Repos | ||||

Cash positions | ||||

Eurex Clearing Prisma, a robust portfolio-based risk management method has been introduced for all ETD and OTC products.

The Eurex Clearing Prisma method is based on the view of each member's entire portfolio and has the advantage of accounting for hedging and cross-correlation effects through determining the margin requirement on a portfolio level as opposed to a product-by-product view. The single elements in the concept are selected so that risk calculation is made adequately and stably, ensuring that the concept withstands new shocks and changes to the financial markets and flexibly adapts to changes in the risk environment.