The Eurex ESG Index Derivatives segment maintained its strong momentum in Q1 2025, building upon the substantial growth seen in 2024 with a peak in notional volume.

Main facts & figures Q1 2025 - Equity and Fixed Income ESG Index Derivatives

- Total Traded Volume: 900,611 contracts (+20.2% vs. Q1 2024)

- Total Notional Volume: 30.9bn EUR (+76.5% vs. Q1 2024)

- Total Notional Open Interest (OI) peaked in February: 6.8 billion EUR (+18.8% vs. February 2024)

- Average Daily Volume (ADV): 14,295 contracts (+20.2% vs. Q1 2024)

Development highlights Q1 2025

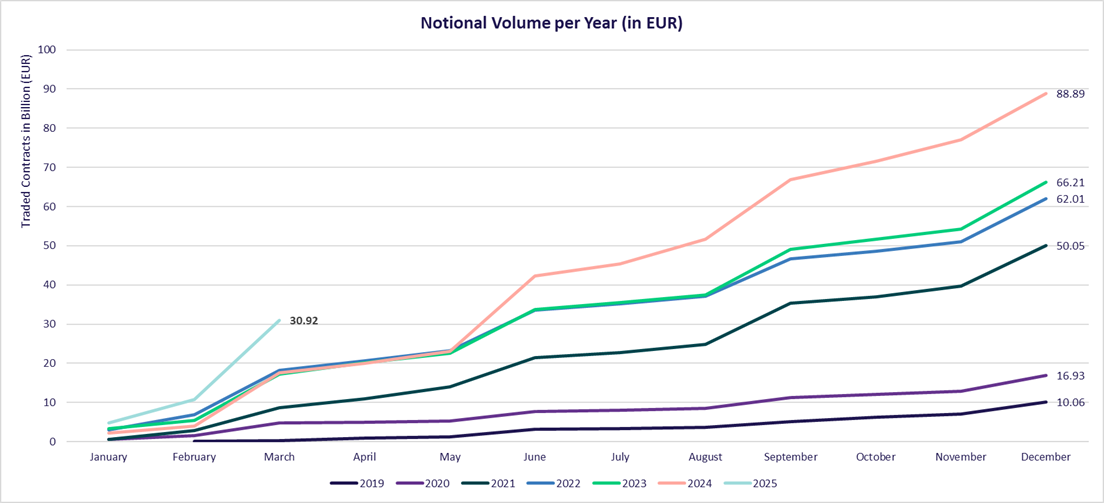

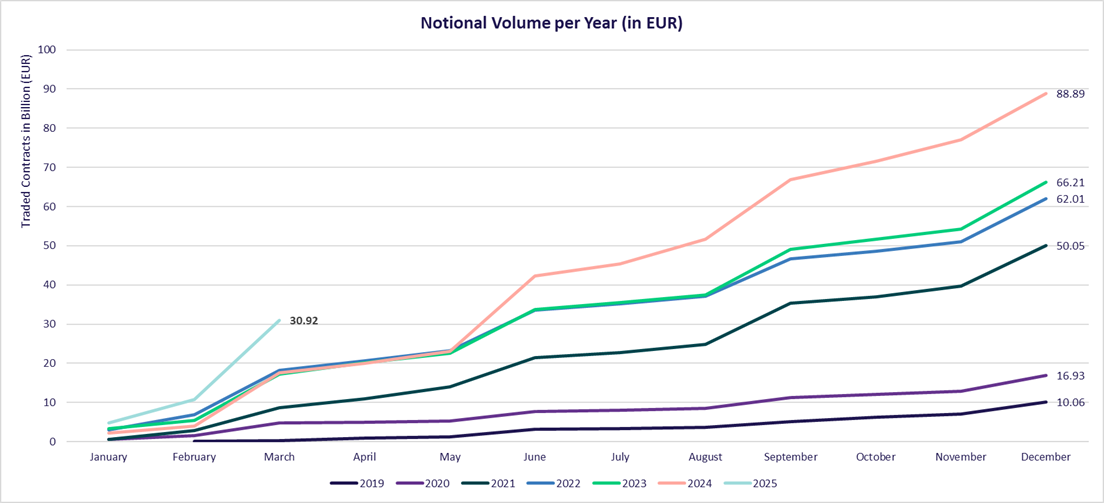

- The cumulated notional volume in Q1 2025 reached more than 30 billion EUR this year, leaving 2023 and 2024 behind by more than 13.4 billion EUR.

- The cumulated notional volume for all ESG Index Derivatives shows a growth of 76.5% compared to 2024.

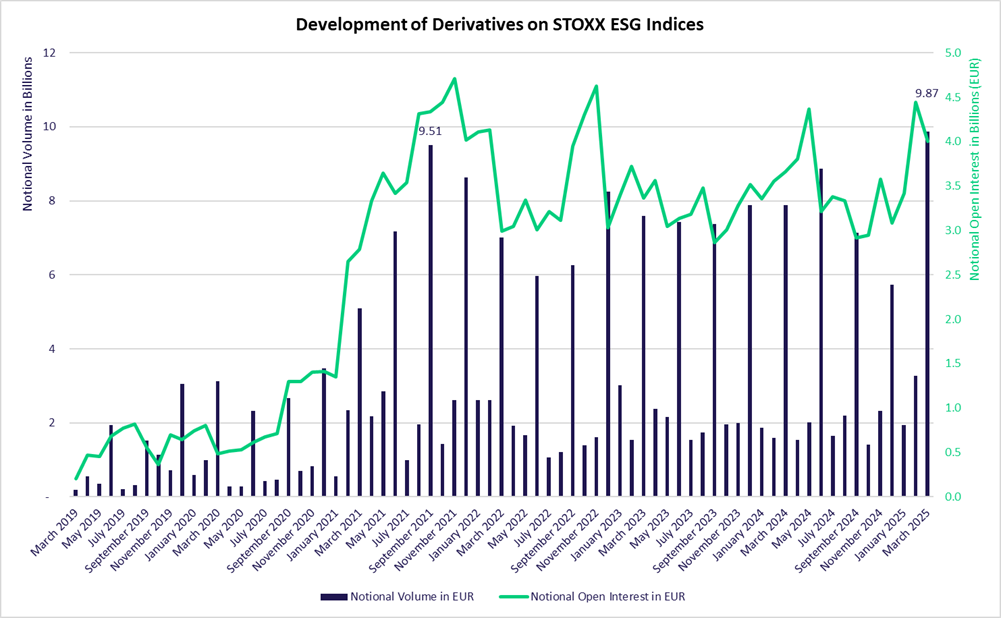

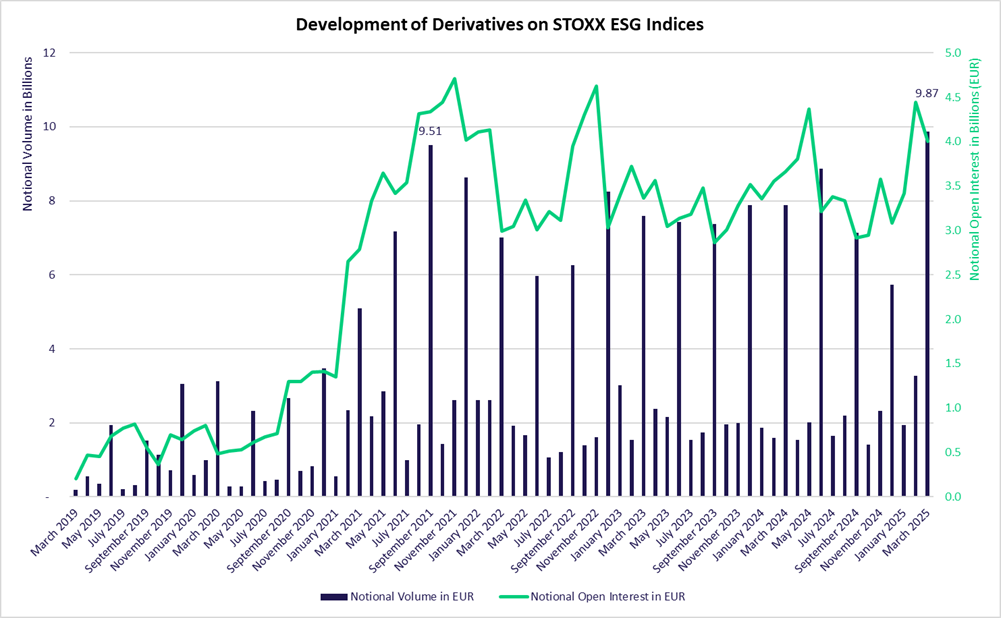

- Notional volume for Equity ESG Index Derivatives is recording a rise of 19.9%, mainly driven by Derivatives on STOXX® ESG Indices with a peak of 9.87 billion EUR in March 2025 (see development chart above).

- The notional volume of all ESG Index Derivatives reached the 20 billion EUR threshold for the first time in March 2025 with 20.1 billion EUR (see chart below).

- Options on EURO STOXX 50® ESG (OSSX) recorded 1.6 billion EUR notional volume traded in the first quarter of 2025. Compared to Q1 last year, it shows a 38.1% growth.

- The traded notional volume of Bloomberg MSCI Euro Corporate SRI Index Futures (FECX) continues the significant growth of 2024 into 2025 with 13.8 billion EUR in Q1 2025, and an all-time high of 8.3 billion EUR traded notional volume in March 2025.

Announcement from index providers on the ESMA Guidelines on funds’ names using ESG or sustainability-related terms:

Changes becoming effective as announced by MSCI for MSCI SRI indices underlying Eurex derivatives:

May 2025 rebalancing

On 22 January 2025, MSCI announced the conclusions from its consultation on potential enhancements to the MSCI SRI Indexes methodology.

During the consultation, market participants supported most of the proposals to keep the exclusions criteria up-to-date and relevant (1), reduce the index turnover, and reduce index concentration.

Changes to Exclusion Criteria:

New Screens

Exclude:

a) all companies deriving 10% or more revenue from oil-related activities.

b) all companies deriving 50% or more revenue from gas-related activities.

c) all companies deriving 50% or more revenue from fossil fuel-based power generation.

d) all companies with evidence of involvement in thermal coal distribution.

e) all companies deriving more than 0% revenue from Arctic Oil & Gas production.

Update to Existing Screen: Fossil Fuel Reserves Ownership

Exclude:

f) all companies with evidence of owning proven & probable coal reserves and/or proven oil and natural gas reserves used for energy purposes or evidence of owning thermal coal reserves.

Screens a) to d) are added to address investors' considerations regarding ESMA Fund Naming and are aligned with the minimum exclusions applicable to the EU Paris-aligned Benchmarks, as outlined in the MSCI EU CTB/PAB Index Framework published in December 2024. For screens a) and b), market participants expressed a preference to use the approach that separates oil and gas revenue in line with the text of Commission Delegated Regulation (EU) 2020/1818.

For the full announcement, please see the MSCI index announcement from 22.1.25. On 3 March 2025, MSCI made the simulated constituents of certain MSCI SRI Indexes following the methodology enhancements available. The simulated snapshots are available at https://www.msci.com/index-consultations.

These enhancements will be implemented at the May 2025 Index Review.