May 20, 2021

Eurex Clearing

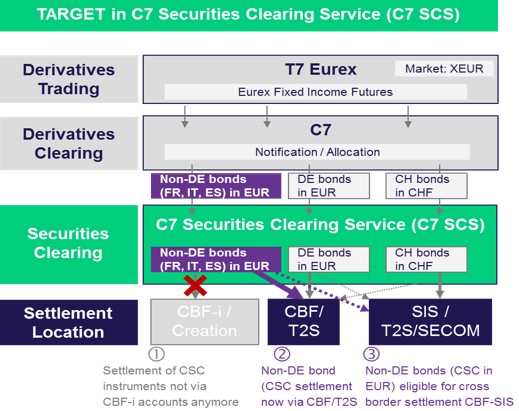

C7 SCS Release 1.0: Change of settlement location for deliveries of French, Italian and Spanish government bonds

1. Introduction

With the introduction of C7 SCS Release 1.0 on 27 September 2021, the settlement location for a settlement instruction will be derived according to the custody type and T2S eligibility of the related securities:

- Instruments in Collective Safe Custody (“CSC”) will settle always on CBF or SIS account at SIX SIS depending on the Clearing Member’s selection for Eurex physical deliveries.

- Instruments in Non-Collective Safe Custody, but T2S eligible (“NCSC-T”) are treated by C7 SCS just as CSC instructions.

Example:

Custody Type | Instrument Types | CSD – current CCP processing | CSD – C7 SCS processing | ||||||

CSC | German bonds, | CBF or SIS | CBF or SIS | ||||||

CSC | Non-DE bonds in EUR | CBF-i | CBF or SIS | ||||||

NCSC | NCSC equities and NCSC bonds | CBF-i | CBF-i |

Current processing

Non-DE bonds deliveries resulting from notification/allocation of Eurex Fixed Income Futures, i.e. French, Italian and Spanish government bonds, are currently settling on CBF-i accounts on the Creation platform, even if they are related to a CSC or NCSC-T bond instrument.

Future processing as of the introduction of C7 SCS Release 1.0

Following the introduction of C7 SCS Release 1.0, these deliveries in instruments with custody type CSC or NCSC-T will settle on CBF or SIS accounts to be in line with all other T2S-eligible instruments allowing their settlement in Central Bank Money.

Production start: 27 September 2021

Learn now more about C7 SCS Release 1.0 on our dedicated initiative page under the following link: Support > Initiatives & Releases > C7 SCS Releases > C7 SCS Release 1.0. System documentation, circulars, timeline and much more information will be available there for you.

... and on the go via the personalized Eurex App.

2. Required action

A. Required action for Italian Bonds settlement

Clearing Members of Eurex Trading Participants trading derivatives, who currently use CBF-i settlement accounts for deliveries resulting from futures notification/allocation for Italian bonds, must provide the tax information (TIN) for Italian Tax Authorities to Clearstream Banking Frankfurt prior to the introduction of C7 SCS Release 1.0.

Please note that the same CBF settlement account that is used for German Bonds settlement will be also used for future Italian Bonds settlement processing. Therefore, the Italian tax information must be provided for the CBF account.

The change of place of settlement can result in two different scenarios,

a) the settlement will move from the CBF-i to the CBF account, then the taxation information must be transferred from the CBF-i to the CBF account, or

b) the settlement account used for German Bonds settlement is an SIS account. In this case, no further steps are required as SIS does not support the taxation relief for Italian Bonds delivery.

Please contact your Clearing Key Account Manager to receive information on your current account set-up for Eurex Derivative deliveries. This step is mandatory to ensure orderly delivery of Italian bonds out of futures notification as of the December 2021 futures expiration.

Detailed information on the tax transfer between CBF-i and CBF accounts can be found in the “General Information on Tax certification transfer by Clearstream” document provided in the Attachment and on the C7 SCS initiative page under the following link:

Support > Initiatives & Releases > C7 SCS Releases > C7 SCS Release 1.0 > Functional Manuals

B. Required action for Spanish/French Bond settlement

A one-time tax certification for Spanish Bonds might be in place on the CBF-i account. Clearing Members can request the duplicate of One-Time certification for certificates for new certificate version from 20 November 2020. Otherwise, Clearing Members have to request it for the CBF account again. If you wish the same taxation on the CBF account, see the “General Information on Tax certification transfer by Clearstream” document in the Attachment. However, this is not a mandatory requirement for settlement of deliveries of Spanish Bonds. In case no one-time certificate is in place, the full taxation will be applied.

French fixed income instruments will change their place of settlement from CBF-i to CBF/T2S, but no additional changes on the CBF side is needed for the orderly settlement of deliveries.

3. Details of the initiative

The future process flow for Eurex Fixed Income Futures, especially Non-DE bonds (FR, IT, ES) in EUR, is presented below:

Please find below the list of Eurex Fixed Income Futures resulting in physical settlement of governmental bonds in EUR for Non-German markets, as currently set up in production:

Eurex Product ID | Country | Expiration cycle | ||||

FBTM | IT | Quarterly | ||||

FBTP | IT | Quarterly | ||||

FBTS | IT | Quarterly | ||||

FOAM | FR | Quarterly | ||||

FOAT | FR | Quarterly | ||||

FBON | ES | Quarterly |

Deliverable Bonds for Fixed Income Futures are published on the Eurex website under the following link:

Data > Clearing files > Notified Bonds | Deliverable Bonds and Conversion Factors

For settlement of Italian bond instruments, a Tax Information Identifier (TIN) for the beneficial owner is required. C7 SCS will send the TIN of the Trading Member in the settlement instruction to CBF.

Eurex Clearing’s own CBF settlement account used for CSC bonds settlement in EUR from trading venue XEUR will be CBF a/c 75300000.

The Settlement Account Clearing Settings for Italian Bonds deliveries can differ from the ones from other physical deliveries in instruments with custody type “CSC” for the same settlement account and Trading Member. The Clearing Member can provide an update to the processing settings via the "C7 SCS Application for Settlement Account Setup/Change/Delete" form, using the sheet ”Italian Bonds Settings”. The form is available on the C7 SCS Release 1.0 initiative page under the following link:

Support > Initiatives & Releases > C7 SCS Releases > C7 SCS Release 1.0 > Functional Manuals

In the C7 SCS system, the dedicated settings are stored within account usage “TIN”. For Clearing Members not wishing to adapt their processing settings for Italian Bonds, the default values “Processing Model=Net” and “Release Method=Released” will be applied, otherwise the amended "TIN"-account settings can be provided via the "C7 SCS Application for Settlement Account Setup/Change/Delete" form.

Market specifics for Italy

Please refer to the Clearstream website www.clearstream.com for

- the process description “Overall process for tax calculation/exemption from withholding tax - Italian debt securities”

- forms “Tax Forms to use – Italy” including Master Instruction and Self Certification.

Market specifics for Spain

Please refer to the Clearstream website for

- the process description “Overall process for tax calculation/exemption from withholding tax - Spanish debt securities”

- forms “Tax Forms to use – Spain”

For tax certification requests and dedicated questions with regards to taxation please contact: Clearstream Tax Support, e-mail: tax@clearstream.com.

Please ensure that the certification is completed before the start of C7 SCS Release 1.0 on 27 September 2021 and approach Clearstream Tax Support with sufficient lead time.

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions of Eurex Clearing AG, as applicable.

Attachment:

- General Information on Tax certification transfer by Clearstream

Further information

Recipients: | All Clearing Members, Basic Clearing Members, Disclosed Direct Clients and FCM Clearing Members of Eurex Clearing AG, vendors and other affected contractual parties | |

Target groups: | Front Office/Trading, Middle + Backoffice | |

Contact: | client.services@eurex.com | |

Web: | Support > Initiatives & Releases > C7 SCS Releases > C7 SCS Release 1.0 | |

Authorized by: | Jens Janka |