Equity Bespoke Baskets for Futures

Equity Bespoke Basket (EBB), formerly known as Equity Basket Trades (EBT), is an expansion of existing Basket for Total Return Futures (BTRF) functionality for other products. In this phase, Eurex introduced the following products to the existing EBB functionality: single stock futures (SSF), single stock dividend futures (SSDF) and stock tracking futures (STF).

EBB is based on an opt-in functionality in T7 trading system, which is only available for Clearing Members with corresponding entitlement.

- A basket functionality already exists for BTRF whereby multiple contracts could be traded as a package

- Baskets are maintained on a gross basis

- These baskets contain a unique FIXML identifier (Basket ID)

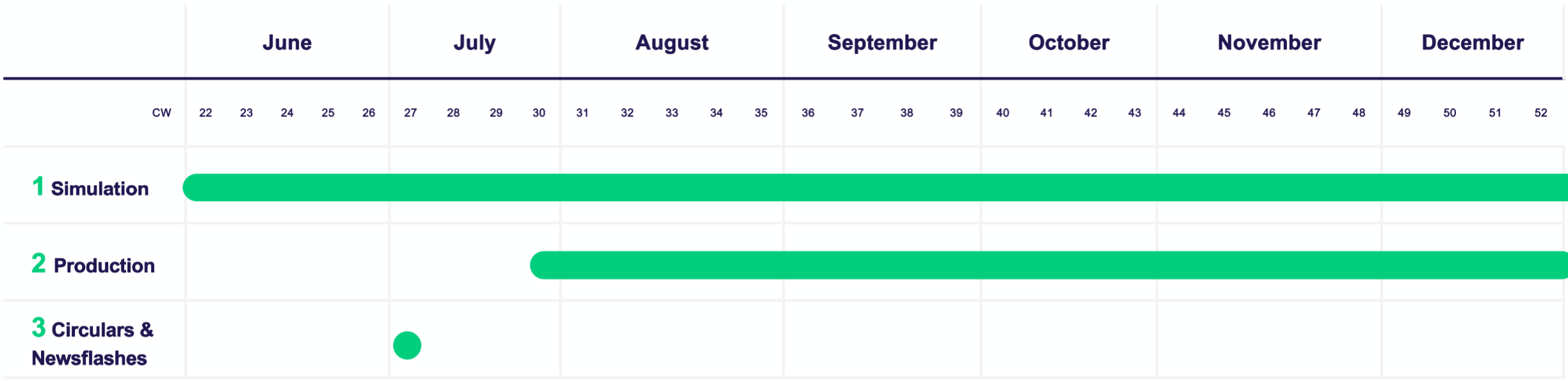

Simulation start: 10 May 2021

Production start: 26 July 2021

Participants Requirements

Changes | Details | Action Item |

Equity Bespoke Baskets (EBB) for futures | FIXML new fields: FirmTrdID reflects the Bank’s Own Reference ID (FIXML tag 1041). This field will not be kept in C7 clearing system at position level, but only at the trade level. This optional field is envisaged to be used for search purposes or internal reconciliation. Impacted clearing reports:

| This is an optional functionality and Clearing Members can opt-in by signing the entitlement form which can be obtained from their Clearing Key Account Manager. Please note this “opt-in” entitlement does not cover trade give-ups/take-ups. There is a risk of a Clearing Members giving up a basket trade to another Clearing Member who is not prepared to handle basket trades. In order to mitigate this risk, we recommend Clearing Members and ISVs to introduce internal controls on their side (e.g. set up a mechanism to auto reject such take-ups based on Package ID). Clearing Members who wish to start clearing EBB, will need to make the necessary implementations on their back office systems and FIXML interfaces, as well as in the reporting tool. |

Contacts

Eurex Frankfurt AG

Customer Technical Support / Technical Helpdesk

Service times from Monday 01:00 – Friday 23:00 CET

(no service on Saturday and Sunday)

T +49-69-211-VIP / +49-69-211-1 08 88 (all)

Eurex Frankfurt AG

Key Account Management

Service times from 09:00 - 18:00 CET

Are you looking for information on previous releases/projects? We have stored information about our previous releases/projects in our Archive for you!