01 Dec 2022

Eurex | Eurex Clearing

The Eurex-LCH CCP basis – when opportunity knocks, it’s time to open the door

Executive Summary

- The European Commission has set itself the objective to build a strong and attractive central clearing capacity in the EU. Eurex Clearing aims to be the global home of the euro yield curve and is committed to promoting market-driven solutions to the European Commission’s objective.

- One of the main market structure themes that needs to be discussed along the journey is the CCP basis (i.e., the Eurex-LCH basis) for cleared interest rate swaps. The CCP basis results in higher pricing for one side of the trade flow (e.g., pay-fixed), and beneficial pricing for the other side (e.g., receive-fixed).

- The drivers of the Eurex-LCH basis are multidimensional and highly complex, and the recent observed market behavior continues to test the market’s conventional understanding.

- While we have seen some significant moves in the basis over the last six months in particular, we do not see that linked to a fundamental imbalance in payer and receiver client flow cleared via Eurex Clearing

- Encouraging market participants who are natural beneficiaries of the Eurex-LCH basis to seize the opportunities will be key to minimizing basis levels and the volatility in the basis levels. Further, increasing activity and liquidity in Eurex-LCH basis swaps, with the right mix of participants will also be important aspects.

Introduction

The departure of the United Kingdom from the European Union (EU) has put a spotlight on the risks to financial stability of continued reliance of third country central counterparties (CCPs) for the clearing of EUR-denominated financial derivatives. The European Commission has set itself the objective to build a strong and attractive central clearing capacity in the EU through a combination of different policy measures that are under development and review. With global notional outstanding of cleared EUR-denominated OTC interest rate swaps (IRS) at c. EUR 80 trillion as at H1 20221, this segment remains the focus of policy discussions with over 90% in terms of cleared notional still serviced at LCH Ltd in the United Kingdom.

Eurex Clearing is the leading derivatives clearinghouse in the European Union. As the clearinghouse for Eurex’s flagship benchmark euro interest rate (Bund, Bobl, Schatz, Buxl) futures markets, it has a stated ambition to be the global home of the euro yield curve. Eurex Clearing has long been an advocate of market-driven solutions to the European Commission’s objectives and has publicly advocated against more punitive measures which could have wider financial stability implications and unintended consequences. Through a partnership program with major dealers and market participants, Eurex Clearing has built a material market share in euro OTC IRS and has positioned itself as the European clearinghouse alternative in line with the European Commission’s objectives. A key theme on the journey building out Eurex’s position to a substantial market share (i.e., significant enough to address the Commission’s financial stability concerns) is the CCP basis (Eurex-LCH Basis), which is the difference in rates for the same swap transactions cleared at two different CCPs (Eurex and LCH). The CCP basis results in higher pricing for one side of the trade flow (e.g., pay-fixed), and beneficial pricing for the other side (e.g., receive-fixed).

Our motivations in writing this paper on the Eurex-LCH basis are three-fold. Since the signaling by the ECB of a monetary policy tightening regime in H1 2022, there have been persistent pricing anomalies in some of the most liquid areas of the rates markets, including euro OTC IRS. The Eurex-LCH basis has also shown highly unusual behavior during this period. While data limitations (i.e., data for trades cleared at LCH) prevent us providing definitive explanations for these anomalous basis movements, we feel there is still value in educating stakeholders on the high-level drivers for the existence of the CCP basis. Secondly, the occurrence of any basis in financial markets brings with it, the potential for trading opportunities. By bringing transparency to the Eurex-LCH basis we aim to move it up the agenda of those market participants who actively exploit such opportunities. Finally, as the euro clearing policy debate continues, policymakers are expecting substance behind the ‘market-driven solutions to market structure challenges’ arguments made by the industry. If there was ever an example of a market structure challenge that should be solved by the market, rather than via policy measures, it would have to be the Eurex-LCH basis.

1 According to the Bank of International Settlements (see https://stats.bis.org/statx/srs/table/d7)

Historical behavior of the Eurex-LCH basis

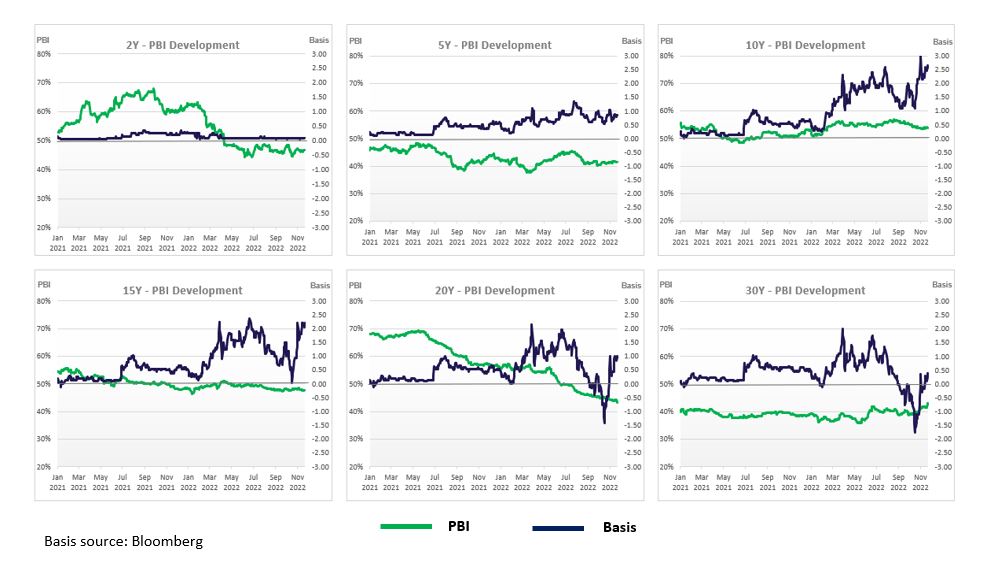

The historical behavior of the Eurex-LCH basis is shown in the chart below. The Eurex-LCH basis has a prominent, albeit variable, term structure which will be discussed later in the paper. While not unexpected, it is noteworthy that the periods of volatility in the Eurex-LCH basis do coincide with macroeconomic events impacting the Eurozone.

Fundamental drivers for the CCP Basis

The Eurex-LCH basis is the third major CCP basis to arise in the past decade, alongside the LCH-JSCC basis for yen-denominated swaps and the more prominent LCH-CME basis for USD-denominated swaps. Despite being such an important market phenomenon, the academic literature on the CCP-basis has remained sparse, with the exception being the landmark working paper2 on the LCH-CME basis, “The Cost of Clearing Fragmentation”, published independently by both the Bank of England and the Bank of International Settlements. However, some of the most insightful thought leadership on the CCP-basis has come from Clarus Financial Technology3 (now part of ION Markets). In a series of blog posts beginning as early as 2014, the principals have closely monitored the behavior of the LCH-CME basis (among others) and have been able to build an admirable conceptual understanding that bridges the theoretical and the practical.

An OTC IRS cleared at Eurex or LCH is economically the same instrument, i.e., identical in contractual terms, which leads many to the conclusion that the Eurex-LCH basis should be the exception, and not the rule. However, nothing could be further from the truth. The Eurex and LCH markets for cleared OTC IRS are two distinct liquidity pools with different compositions of derivative end-users (i.e., clients), different inherent ‘costs to participate‘, and different service/value propositions. The common denominator is the dealer community, consisting of large international banks and broker dealers, and large clients that have the resources to operate across both Eurex and LCH liquidity pools.

2 BIS Working Papers No 826, The Cost of Clearing Fragmentation, by E. Benos, W. Huang, A. Menkveld and M. Vasios

3 https://www.clarusft.com/blog/

Client composition

CCPs require initial margin from its members and clients to the extent that positions are not balanced in terms of market risk. Hence when a dealer services a client in the Eurex liquidity pool with a sell order, it ideally should also service a client with a buy order in the Eurex liquidity pool to remain balanced in terms of market risk at the dealer level and be balanced at the CCP (Eurex) level. If an offsetting client buy order cannot be found in the Eurex liquidity pool, the position can be hedged with another dealer also in the Eurex liquidity pool to remain balanced in terms of market risk. If there is insufficient liquidity in the Eurex pool, the dealer may have to turn to the LCH inter-dealer liquidity pool to look for balancing positions. If this alternative is taken up, this will leave the dealer balanced in terms of market risk at the dealer level but not at the CCP level, which means the dealer incurs margin costs. If this is an enduring situation, the dealer will factor in the costs of holding margin at Eurex by adjusting the pricing it provides to clients in the Eurex liquidity pool. If a substantial portion of dealers apply this ‘margin valuation adjustment‘, this gives rise to a CCP (Eurex-LCH) basis.

As a starting point, it’s useful to consider the Eurex-LCH basis as a form of margin value adjustment (MVA). This MVA is applied by dealers to the pricing of OTC IRS to address the costs of initial margin posted at Eurex, arising from the imbalance of fixed payers and fixed receivers among end-user clients of the dealer. Supporting this reasoning is that end-user client portfolios are generally directional, and end-user clients may exhibit a preference for, or only have resources to access, one CCP. At Eurex, we regularly monitor the balance of fixed payers and fixed receivers using an internal metric called the Portfolio Balance Indicator (PBI), which uses net DV01 by client as a proxy measure of exposure. To ensure an accurate picture of client end-user activity, dealer activity is excluded on a best endeavors basis.

Costs to participate

The Eurex-LCH basis must also be influenced by more direct factors such as the ‘costs to participate’, the most obvious of which is margin methodology differences. CCPs use different models, methodologies and assumptions in the calculation of initial margin, possibly resulting in different margin requirements for the same underlying trade. Similarly, differences in fees and charges (e.g., clearing fees, membership fees, securities collateral charges etc.) will inevitably impact the basis. However, we do not see these factors as significant as fee frameworks are competitive and regulatory constraints tend to keep margin levels broadly aligned, thereby reducing the potential for a “race to the bottom”.

As initial margin needs to be funded, the dealer’s credit risk, and ultimately funding costs, also potentially influence the level of the Eurex-LCH basis. The dealer firm’s funding costs in the wholesale market should be differentiated from the funding costs charged to the trading desk by the dealer firm’s internal treasury. Our discussions with market participants suggest, at least anecdotally, that both the former and the latter can vary considerably across dealers.

Service/value proposition

There is another dimension to assessing the size of adjustment applied by dealers, which is the service/value proposition offered by the respective CCPs. LCH offers multicurrency netting and margining capability, while Eurex Clearing offers cross-product margining4, and both offer rebates and incentive programs. The clearing decision, and by extension the Eurex-LCH basis, will be influenced by these service/value proposition dimensions.

Anecdotally, the costs to participate and the service/value proposition are understood to be of secondary importance to the Eurex-LCH basis compared to the market structure drivers such as fixed payer and fixed receiver imbalances of end-user clients, which is expected to account for most of the volatility. Notwithstanding, these factors are also not insignificant and need to be monitored as new regimes emerge (e.g., monetary policy tightening, margin parameter recalibrations, strategy/organizational changes at major dealers).

4 Eurex Clearing also offers multicurrency netting and margining capability, but the liquidity of non-Euro OTC IRS is in the early stages of development

Eurex-LCH basis vs PBI

The Eurex-LCH basis has a very prominent term structure. The term structure of the Eurex-LCH basis behaves dynamically, with correlations and dependencies that can change rapidly depending on the prevailing macroeconomic environment. Finance textbooks have long taught the market segmentation theory, which holds that different segments of the yield curve are controlled by the supply and demand of different types of clients. The dynamic behavior of the Eurex-LCH basis term structure is very consistent with this theory of market segmentation.

The time series of the PBI shows the balance to be reasonable, but not perfect for some tenors, which in principle supports the existence of a basis. However, it is of significant interest that while the PBI directionality for each tenor has remained consistent (i.e., 2yr, 5yr, 10yr, 20yr marginally skewed towards fixed payers; and 30yr skewed towards fixed receivers), the basis has moved between positive and negative territory at certain points in history. Furthermore, when the PBI has trended toward a more balanced distribution between fixed payers and fixed receivers, the Eurex-LCH basis has not trended to zero.

The behavior observed has implications for how we think about the underlying drivers of the basis. Based on the theory that the Eurex-LCH basis is a form of MVA, maintaining a balance between fixed payers and fixed receiver end clients at Eurex is important to minimize the basis. However, perhaps what is more important is that the structure of fixed payers and fixed receiver end clients at Eurex matches the structure at LCH. Hence, for the CCP basis to be minimized, it is more important that the LCH and Eurex markets look and behave as one, rather than two distinct liquidity pools. While the public disclosures of CCP exposures do not provide the level of detail for this to be properly assessed, it is clear that minimizing the CCP basis and its volatility requires more than simply requiring a balance of fixed payers and fixed receivers of end-user clients at Eurex.

Earlier sections in this paper discussed various drivers of the CCP basis, including supply and demand characteristics, differences in costs of participating, and differences in service/value propositions. An important consideration is that when dealers adjust the pricing for Eurex vs LCH markets, they take into account a forward-looking view of those factors. As these views are likely to vary significantly across dealers, it highlights the challenges of analytically reviewing the Eurex-LCH basis against the fundamental drivers. Indeed, these challenges have been most pronounced in Q3 and Q4 2022. A detailed analytical review of the dealer and client trading activity reveals no discernable aggregated trends. We observe what can only be described as “random tactical positioning” amongst clients and dealers.

Trading opportunities

The Eurex-LCH basis, like the occurrence of any basis in financial markets, brings with it the potential for trading opportunities. Historically we have seen a number of instances of short-term anomalous widening of the basis at the different tenors. These have mainly been event-driven, with reversion back to a ‘normal’ range after a short period and, in some cases, a ‘new normal’ range. The reversion back to normal is due to the simple fact that the Eurex-LCH basis is an opportunity ready to be taken. A positive Eurex-LCH basis should attract fixed receivers to Eurex with more competitive pricing and vice-versa for a negative basis. The faster these opportunities are taken, the faster the basis narrows.

This leads nicely to the next question of whether the Eurex-LCH basis is the economist’s proverbial USD 20 bill lying on the ground. A material pricing difference for the same economic instrument in two different markets would suggest it is, but the reality far more complicated. A CCP basis swap will deliver arbitrage profits based on the pricing differences. However, initial margin will need to be posted for the respective trades at Eurex and LCH, and this will incur funding costs which could be significant enough over the life of the trade to completely offset the arbitrage profits.

There are additional peripheral costs, such as execution fees, clearing fees and capital costs which further impact the profitability of the trade. So, the existence of a basis does imply arbitrage profits, but one must consider the all-in costs to understand whether the trade still makes sense economically. It is important to note that taking advantage of the basis as a buy-and-hold user is in any case reasonable, but the economic sense question in this context refers to the arbitrage opportunity. Recognizing that funding costs and capital costs can vary significantly across different market participants, there may well be scope to minimize basis levels and basis volatility further if the right participants were active in the market.

Eurex-LCH basis swaps are also commonly used by market participants to optimize margin requirements across two CCPs. Once again, this requires careful analysis of the economics as the margin funding costs savings would need to be sufficient to offset the trading losses from: i) paying away the basis; and ii) crossing the bid-offer spread.

Increasing transparency around portfolio structures and the CCP Basis

Developing an active, liquid market in Eurex-LCH basis swaps, with the right mix of participants, will be key to minimizing basis levels and the volatility in the basis levels. In this regard, Eurex continues to maintain strong working relationships with interdealer brokers and non-dealer market participants. Further, the OTC IRD partnership program provides incentives for services which promote CCP basis trading. To encourage market participants to act quicker when the opportunities arise, we aim to bring much more transparency to the Eurex-LCH basis. Going forward, we expect to provide more comprehensive breakdowns of Eurex’s client and dealer volumes, alongside improved disclosure of the PBI by tenor. This will enable market participants to better-differentiate portfolio structure changes from market anomalies in their assessment of the Eurex-LCH basis.