May 08, 2018

Eurex Clearing

Part 5: Cash management and investment policy

Pioneering CCP Transparency Series

The Public Quantitative Disclosure (PQD) is an internationally agreed format defined by CPMI-IOSCO with the intention of enhancing CCP market transparency. Eurex Clearing has been publishing its PQD since 2015 and continues to strongly support CCP transparency and market stability.

With the disclosure for Q4/2016, Eurex Clearing began a series of commentary to highlight key trends, discuss current topics and shed some light on selected data points. The current note is the fifth part of the series and contains key highlights for the fourth quarter of 2017 regarding the investment policy of Eurex Clearing.

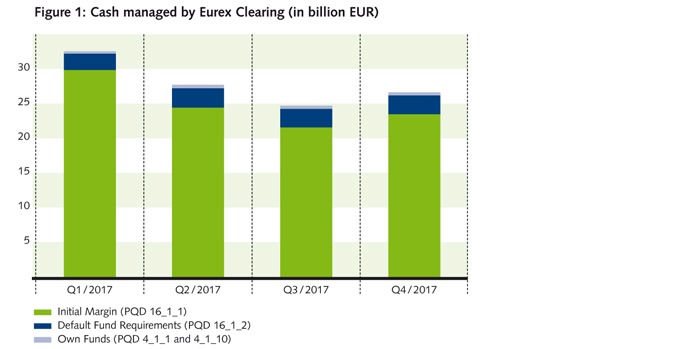

Cash management

Eurex Clearing accepts cash collateral to cover margin and default fund requirements in the currencies EUR, CHF and GBP. For these currencies, Eurex Clearing has access to the deposit facility of the respective central bank. In order to cover intraday margin calls after 14:00 CET, Clearing Members may provide cash collateral in USD that has to be replaced by funds in a clearing currency or securities collateral on the following day.

Investment policy

The investment policy of Eurex Clearing assigns the highest priority to the principles of a) capital preservation to minimise credit and market risk, and b) liquidity maximization to ensure Eurex Clearing’s ability to satisfy payment obligations at all times. The guidelines comprise key criteria for

- Collateralization

- Counterparty quality

- Collateral quality

- Placement tenor

Eurex Clearing invests Clearing Members’ cash collateral only in highly liquid financial instruments. Deposits are to be secured to the extent possible by, or to be claims on, high quality obligors. Reverse repo is the preferred instrument. Funds may also be invested through direct securities purchases. Uninvested amounts are deposited with central banks if access has been granted or, in the opposite case, with authorized credit institutions. In principle, Clearing Member cash collateral is placed in the same currency as provided by the Clearing Members in order to avoid foreign exchange risk.

To qualify as collateral for repo transactions or for direct investments, securities have to meet each of the criteria of highly liquid financial instruments bearing minimal market and credit risk. To ensure diversification, concentration limits are established and implemented at different levels such as counterparty, issuer and country limits.

A limited part of Clearing Members’ cash collateral may be placed longer than overnight. The established thresholds for term investments are part of Eurex Clearing’s comprehensive Liquidity Risk Management Framework.

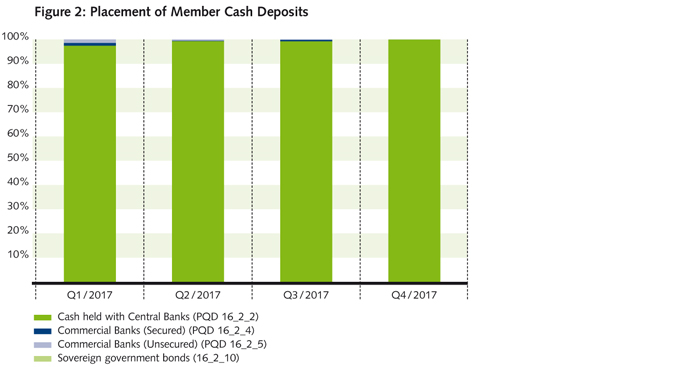

Figure 2 shows the investment of Eurex Clearing’s cash collateral in 2017. Due to the prevailing negative interest rate environment in EUR and CHF, 99 percent of funds are placed with central banks.

As the access to central banks for all clearing currencies is highly reliable even under severe market stress, Eurex Clearing is able to maintain its conservative investment strategy regardless of the availability of bank counterparties and highly liquid financial instruments.

Currently, interests earned from cash investments are passed on to Clearing Members reduced by a cash handling fee per currency (customer interest rates).

From 3 April 2018, Eurex Clearing has based its calculation of customer interest rates per currency on publicly available benchmark reference rates in order to increase transparency for Clearing Members. Eurex Clearing is thus continuing to follow its conservative investment strategy.