Feb 05, 2021

Eurex Clearing

Calculation of Default Fund contributions: Change to Stress-Loss-over-Margin (SLOM) based methodology effective 1 April 2021

1. Introduction

The calculation of Default Fund contributions will be changed from a percentage of Initial Margin approach to a Stress Loss-over-Margin (SLOM) based methodology.

From the technical go-live of 15 March 2021 onwards, the required contributions according to the new methodology will be visible in the CD090 and CD091 reports, as communicated in Eurex Clearing Circular 110/20. They will be effective starting 1 April 2021 based on the end-of-day values from 31 March 2021 via the monthly recalibration process.

Effective date of report changes: 15 March 2021

Effective date of recalibration: 1 April 2021

2. Required action

Clients are requested to be prepared to meet the new Default Fund contributions based on the SLOM methodology beginning of April 2021. The new contributions can be anticipated starting 15 March 2021 via the above-mentioned reports.

Detailed changes to the reports and respective fields are published in the Prisma Report Reference Manual in the Member Section of Eurex Clearing.

3. Details of the initiative

Default Fund contributions are currently calculated as a percentage of Initial Margin requirements while the operational monitoring and potential mitigation of excess exposure is founded on the Stress Loss-over-Margin (SLOM) metric.

To streamline the two models, the calculation of Default Fund contributions will be aligned to a SLOM-based methodology. The key indicator metric SLOM is calculated as the difference of the simulated value of a portfolio under a certain stress scenario and the total margin requirement of the same portfolio to display potential losses not yet collateralised via margin requirements. The overall default fund size (DF) will be determined as the sum of the 60-business-day average (Ø60d) SLOM values of the two largest Clearing Member Groups (CG):

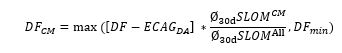

The Default Fund contribution per Clearing Member (CM) is then consistently derived from the proportional SLOM values of each CM subtracting Eurex Clearing’s dedicated amount (ECAG_DA) from the size of the default fund to be distributed on CMs. A 30-business-day average is employed for the calculation of contributions with no changes to minimum Default Fund requirements (DFmin):

The current mitigation process for excess cover-2 exposure via Supplementary Margin remains unchanged.

Unless the context requires otherwise, terms used and not otherwise defined in this circular shall have the meaning ascribed to them in the Clearing Conditions or FCM Clearing Conditions of Eurex Clearing AG, as applicable.

Further information

Recipients: | All Clearing Members, Basic Clearing Members, Disclosed Direct Clients of Eurex Clearing AG and vendors, all FCM Clearing Members and other affected contractual parties | |

Target groups: | Front Office/Trading, Middle + Backoffice | |

Related circular: | Eurex Clearing circular 110/20 | |

Contact: | Risk Exposure Management, tel. +49-69-211-1 24 52, risk@eurex.com | |

Web: | www.eurex.com/ec-en | |

Authorised by: | Dmitrij Senko |