Key Benefits Buy Side

Sponsored Access is designed to give you the speed, control, and flexibility of a direct market participant without the complexity of a full membership.

Key Benefits for buy-side firms:

- Direct connectivity to Eurex’s T7 platform using your own infrastructure

- Lower latency than traditional DMA or ORS setups, ideal for high-frequency and algorithmic strategies

- No exchange membership required, reducing onboarding time and operational overhead

- Tailored risk controls managed by your sponsoring participant, ensuring compliance and safety

- Future-ready infrastructure with support for FIX/ETI, drop copy, and upcoming GUI enhancements. FIX and GUI access will be introduced with version 14.1. Drop copy functionality is available via the external provider (EDC).

Key Benefits Sponsors

Key benefits for sponsors:

- Sponsors can expand their offering to a wider customer base, attracting high-speed, low-latency trading firms deploying algorithmic or latency-sensitive strategies.

- User maintenance made simple with Sponsored Access Provider's maintaining full control of their clients trading by utilizing Eurex's comprehensive risk control functionality.

- The electronic registration tool available in the Deutsche Börse Member section greatly simplifies onboarding 'Sponsored Access Users'.

- Reduced infrastructure requirements for provider with Sponsored Access users establishing their own connections to Eurex.

Core Setup

Sponsored Access (SpA) is more than just an option; it’s a structurally distinct access model designed to meet the needs of latency-sensitive, non-member trading firms.

Under this model:

- Indirect firms connect directly to Eurex’s T7 platform using their own infrastructure.

- Each firm operates under the supervision of a sponsoring Eurex participant, who configures and maintains dedicated risk controls.

- The setup ensures secure, segregated trading activity, with new trader roles tailored to SpA users.

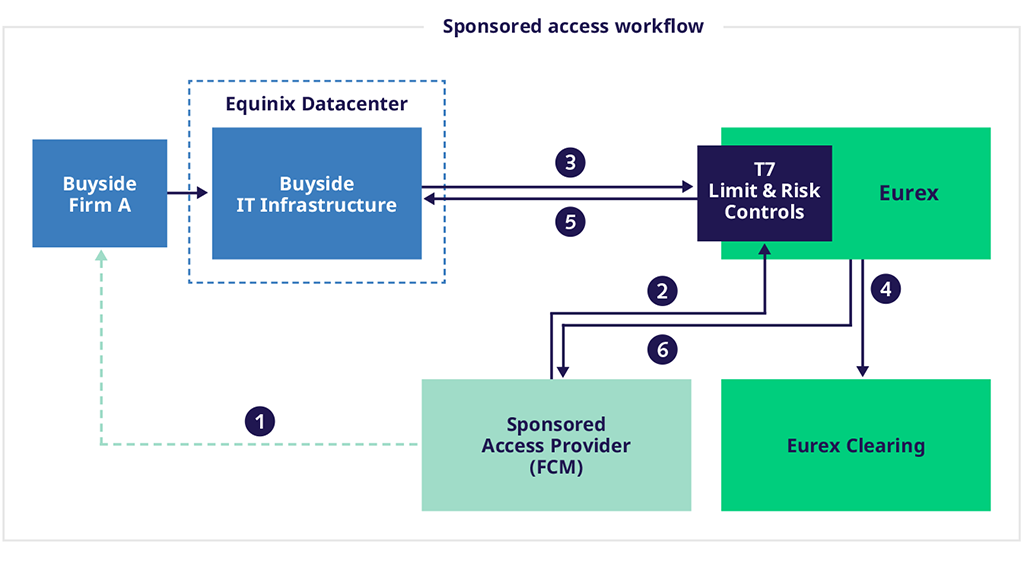

1. Risk Setup by the Sponsor

The sponsoring Eurex participant (FCM) establishes pre-trade risk limits for your firm and its traders in Eurex's T7 system, ensuring safe, compliant trading from day one.

2. Direct Connectivity to Eurex

You connect directly to Eurex via ETI or FIX using your own infrastructure. Connectivity can be arranged either through your sponsor or directly with Eurex (EFAG), depending on your setup.

3. Order Submission

When placing an order, you choose which sponsoring trader ID to route it through. Eurex handles the rest, executing the order with full transparency and speed.

4. Instant Execution & Clearing

Orders are executed in Eurex's T7 platform and cleared immediately, just like any other market participant. Your identity remains confidential to the clearing house (ECAG).

5. Real-Time Monitoring

Eurex sends a FIX drop copy of all trade details to your sponsor, enabling real-time oversight and risk management.

Sponsored Access vs DMA

Sponsored Access

Structurally distinct access model designed to meet the needs of latency-sensitive, non-member trading firms.

- Speed & Transparency:

SpA enables direct connectivity with Eurex's infrastructure, reducing latency and improving transparency. - Exchange-Level Risk Controls:

Unlike DMA/ORS, risk checks are enforced by Eurex itself, ensuring consistent compliance and oversight. - Ideal for Advanced Workflows:

Supports complex trading strategies, making it suitable for sophisticated buy-side firms

DMA (Direct Market Access)

The buy-side firm sends orders through the infrastructure of a member (FCM). The member performs pre-trade checks.

ORS (Order Routing System)

Similar to DMA, but includes additional logic – such as random delays, algorithmic filters, or discretionary controls – before routing orders to the exchange.

How Sponsored Access is different

Feature | DMA/ORS | Sponsored Access (SpA) |

Connectivity | Via FCM member | Direct to the Exchange |

Pre-trade controls | Within the member infrastructure | Within the exchange infrastructure |

Trader ID | Not provided by FCM | Provided by FCM |

Latency | Medium/High | Ultra-low latency |