Nov 11, 2025

Eurex

Focus on VSTOXX® Derivatives | October 2025 recap

European markets finished positive in October. The STOXX® Europe 600 led with a 2.46% rise, followed closely by the EURO STOXX 50® with a 2.39% increase. The DAX Index in Germany was the laggard for the month with only a 0.325% return.

Despite positive equity markets in the month, implied volatility was higher across the board, led by the DAX’s implied volatility, which increased by nearly two vol points. Gains were more muted in SX5E and SXXP as levels rose 0.5 and 0.75 vol points, respectively.

Skew was basically flat during the month, decreasing from 5.72 to 5.49 for 95%-105% skew. Implied correlation rose slightly month over month after hitting the year’s lows in the first two weeks of the month.

Equity Index Volatility

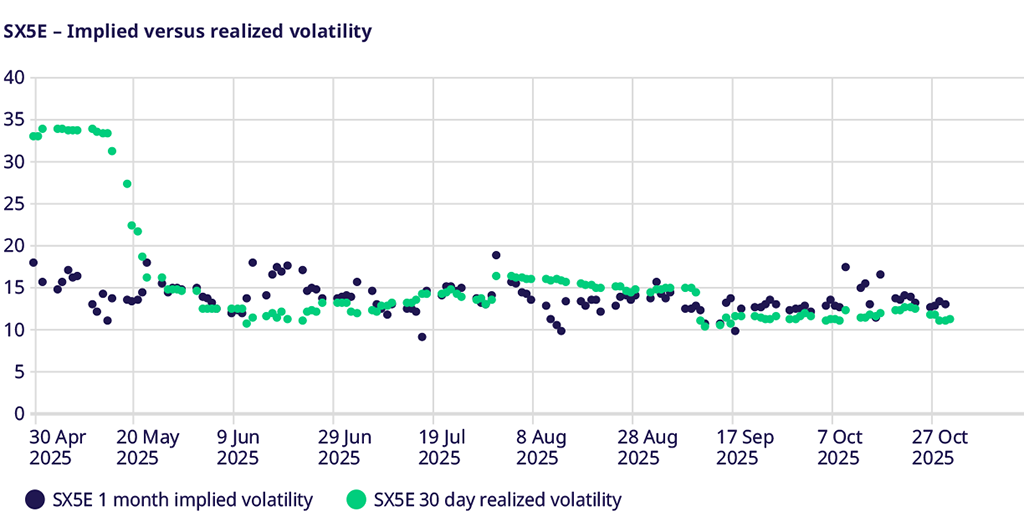

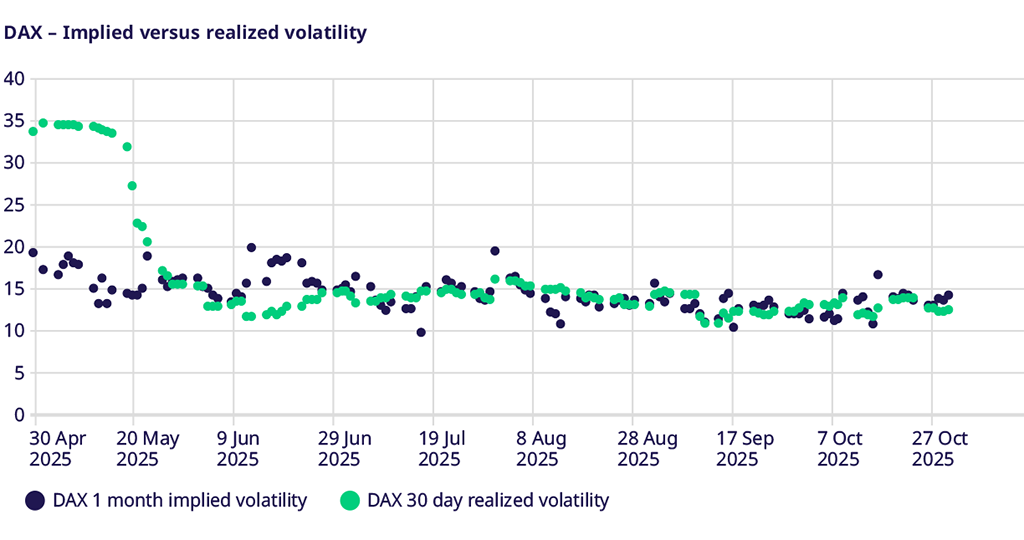

European equity indices rallied over the month, but investors and traders expressed some concern over the ability for these gains to continue, as seen in the implied volatility markets. The DAX’s implied volatility rose from 12.01 to 14.19 even though realized volatility was flat at 12.2. Gains were more muted in SX5E and SXXP as levels rose from 12.42 to 12.97 and 9.78 to 10.52, respectively. However, in each case, the gap between implied and realized volatility also widened, indicating a sense of increasing risk premium.

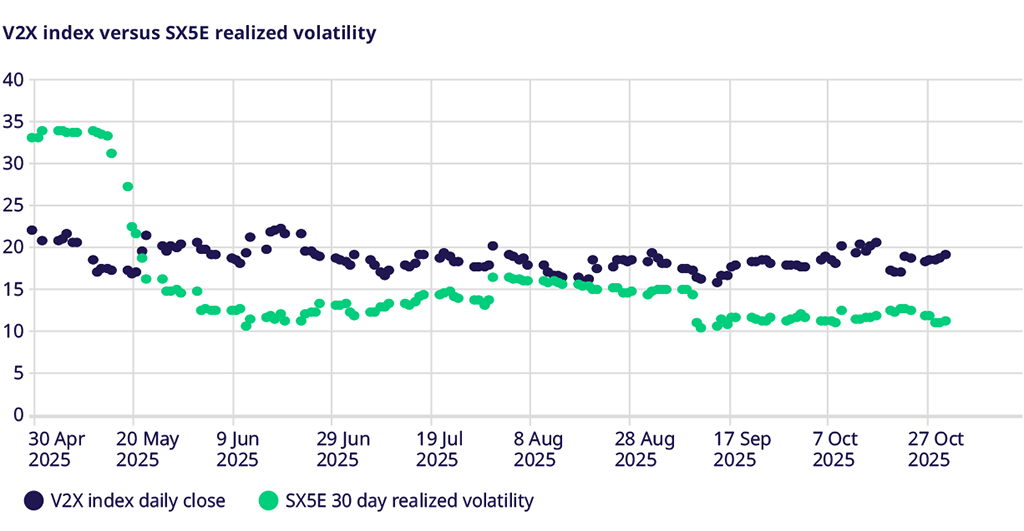

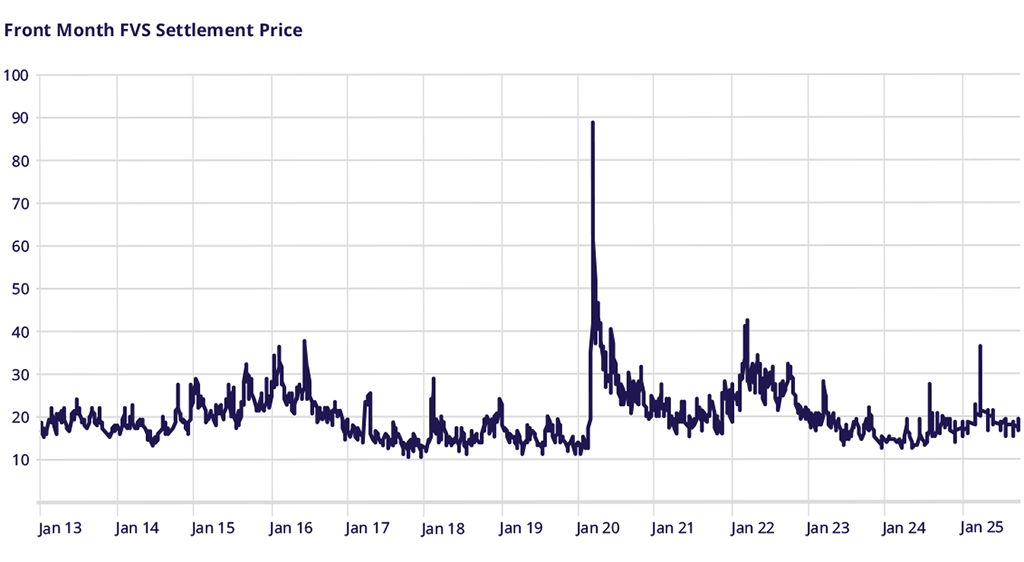

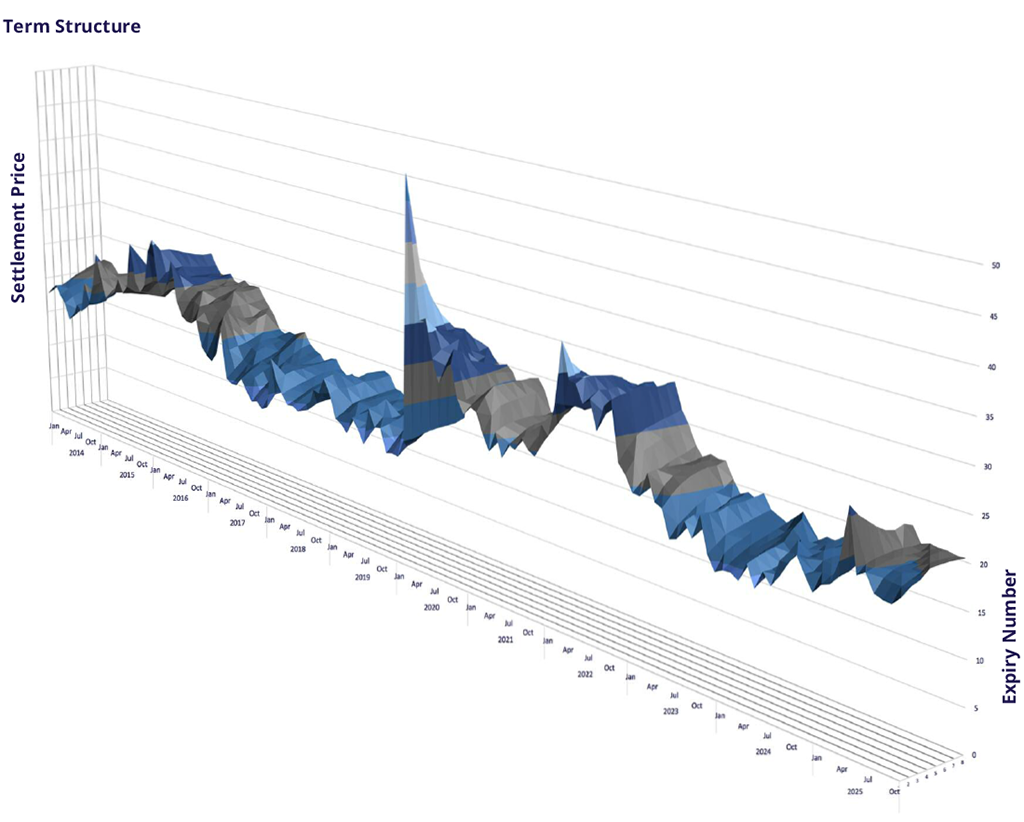

VSTOXX Index Performance

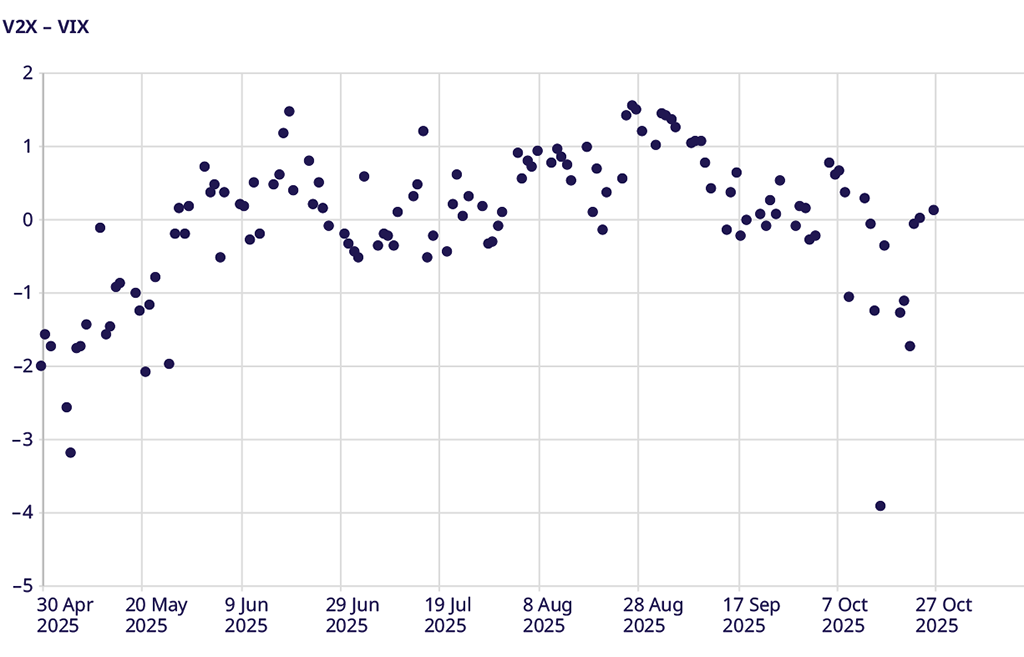

This sense of growing risk premium was also evident in the V2X market. V2X futures rose from 17.75 to 19.0, but more importantly, the spread versus SX5E realized volatility widened from 6.5 points to 8 points over this same period. The spread between V2X and VIX appeared relatively constant on a month-to-month closing basis. However, in the middle of the month, the VIX widened to almost 4 points near October expiration, as US-China trade concerns rattled the US markets but not the European markets. These fears calmed by the month-end, and the spread was back to flat.

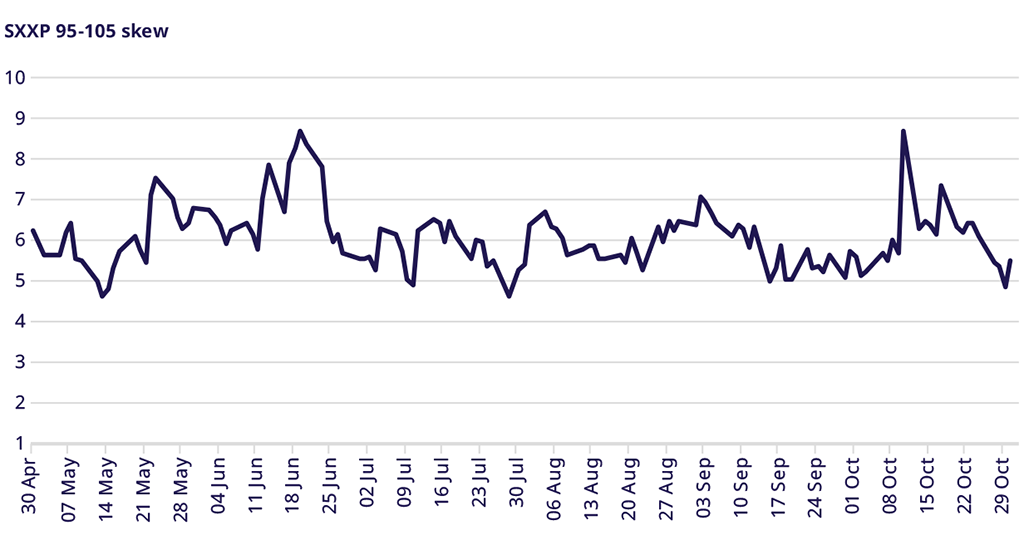

STOXX® Europe 600 Index Skew

Skew, as measured by the difference between 95% puts and 105% calls, stayed flat month-over-month near the long-run average of about 5.5 vol points. Early in the month, the spread widened to over 8 vol points by October 10, when the SX5E Index dropped 2% in a single day due to US-China trade concerns, particularly regarding China's rare earth retaliation. By the end of the month, as markets stabilized and moved higher, skew stabilized and returned to long-term averages.

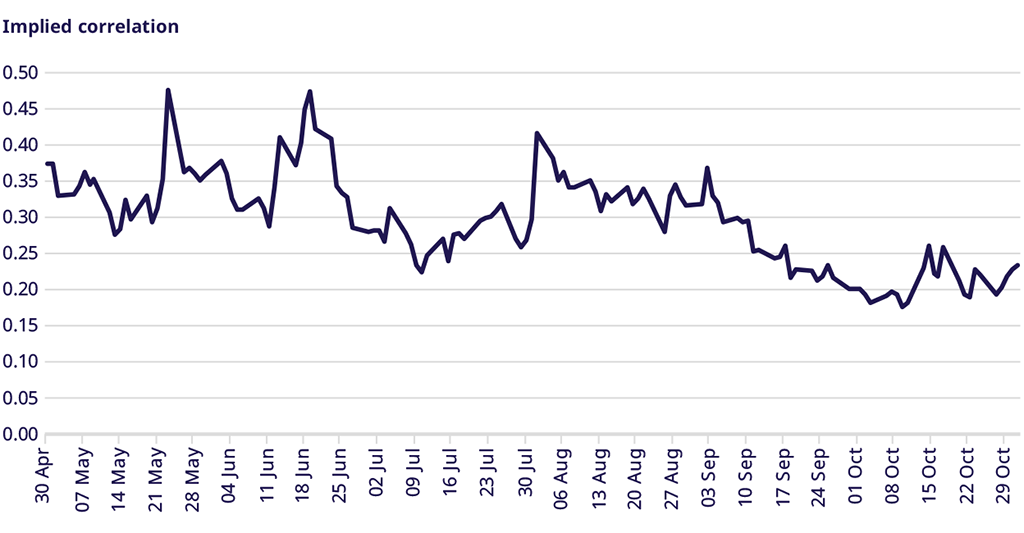

Correlation

Implied correlation fell early in the month in anticipation of company earnings and more idiosyncratic movement. As earnings were reported, implied correlation rose but remains muted on a year-to-date basis.

Trade the European volatility benchmark

Explore this year's macro events and find an overview of dates.

VSTOXX 101: Understanding Europe’s Volatility Benchmark

Discover the latest STOXX whitepaper today to learn more about the VSTOXX® core methodology, historical performance analysis, and more.

For more information, please visit the website or contact: