Oct 13, 2025

Eurex

Eurex Repo Monthly News September 2025

Market briefing: ''Strong growth across all Repo Markets in September – GC Pooling and SSA volumes reach new highs''

by Frank Gast and Carsten Hiller, Eurex Repo

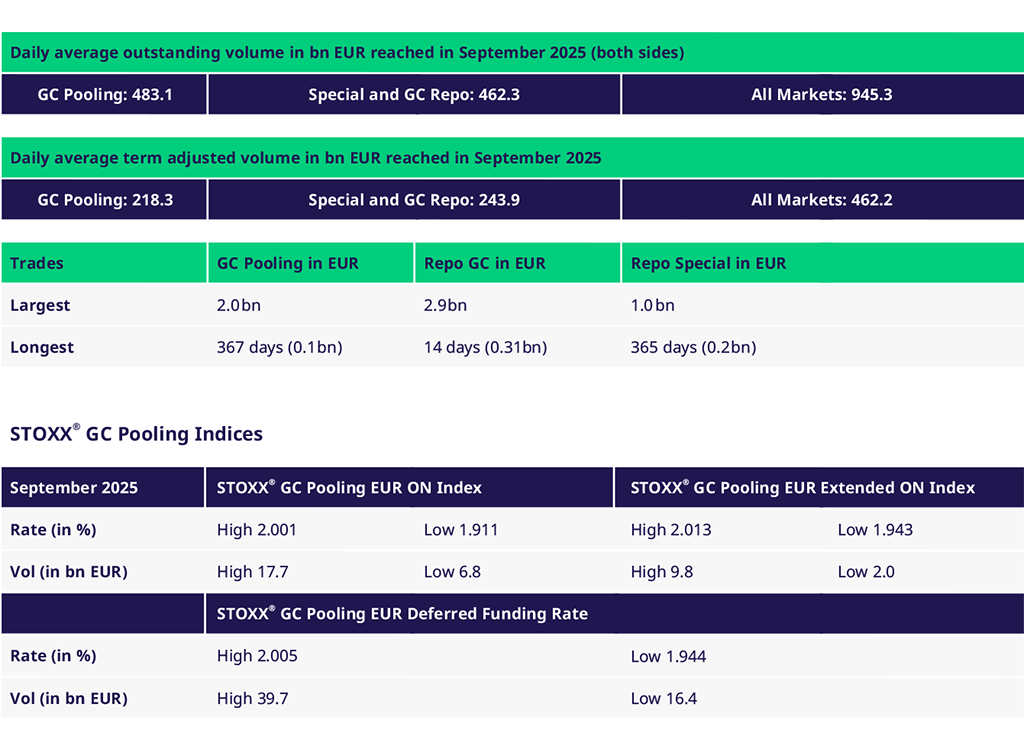

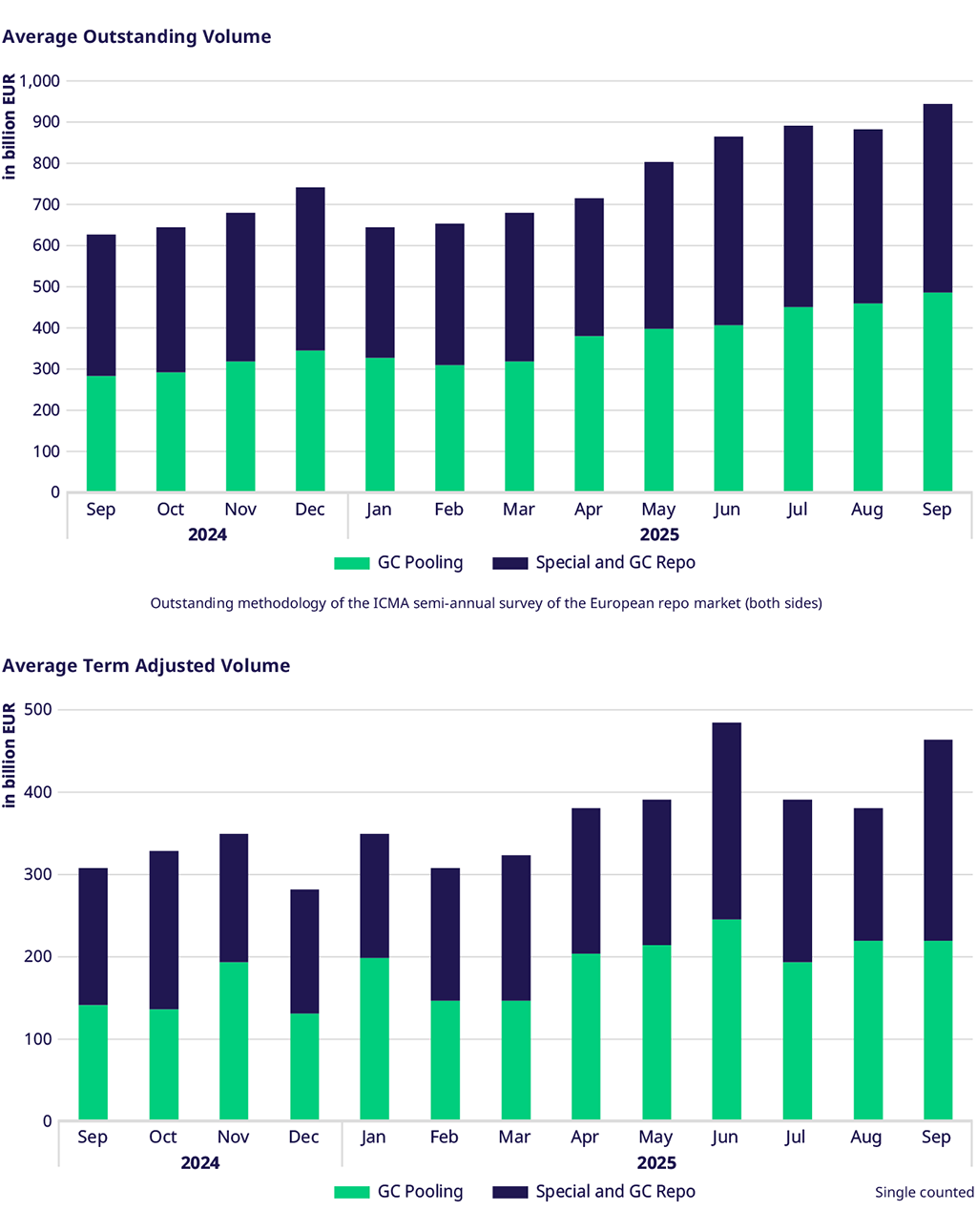

September 2025 saw a robust expansion in term-adjusted volumes, which climbed 52% year-on-year. GC Pooling activity was particularly strong, advancing by 56%, while the combined GC and Special Repo segment posted a 48% increase compared to September 2024.

Looking at the year-to-date figures, term-adjusted volumes across all segments rose by 13%. This growth was primarily fueled by the continued momentum in GC Pooling, which surged 30% over the period. Conversely, the repo market segment recorded a modest decline of 2%.

Outstanding and Traded Volumes

Outstanding volumes set a fresh record in September. On a year-to-date basis, average outstanding volumes improved by 13%, with GC Pooling contributing a significant 27% gain. The GC & Special Repo segment edged up by 2% over the same period.

Average traded volumes were up 2% from August and 12% higher than in September last year. GC Pooling volumes were 22% above their September 2024 level, while the GC & Special Repo segment remained stable year-to-date.

Spreads and Collateral

The average spread between the ECB and EXT baskets widened slightly to 1.25 basis points, largely reflecting a pronounced quarter-end effect, where the spread reached 3.2 basis points versus 1.15 basis points on other days in the month.

Relative to the deposit facility, the spread widened to -1.13 basis points for the ECB basket and narrowed to 0.12 basis points for the EXT basket. This movement was influenced by a dip in rates at quarter-end, with the ECB basket averaging 1.91% and the EXT basket 1.94%.

Quarter-end trading was notably smooth, with volumes holding steady at elevated levels compared to the days preceding month-end. Bund Special repo rates were also well-balanced, with spot/next rates over quarter-end ranging from 1.94% to 2.00%.

GC & Specials

Trading patterns in euro government bonds diverged in September: Bund Special (single ISIN) volumes fell 13% from August, while Italian government bonds saw a 28% jump in average traded volumes. Spanish and French government bonds also posted gains of 18% and 5%, respectively.

SSA volumes delivered a remarkable 34% increase over August, propelled by a 75% surge in EU bonds, which set a new record and marked a 112% rise compared to the 2024 average. This uptick may be linked to the successful launch of the Euro-EU Bond Futures on 10 September.

GC Pooling

GC Pooling traded volumes advanced by 10%, with average term-adjusted GC Pooling volumes remaining steady versus August.

The stability in GC Pooling term-adjusted volumes was supported by active trading in 1-month and 2-month INT MXQ basket transactions, as well as numerous flexible terms in the ECB basket extending into mid-2026.

Volumes

| |||

|

Participants: 166