Jul 15, 2025

Eurex

Eurex Repo Monthly News June 2025

Market briefing: ''Strong term growth and first 3-year trades mark June’s Repo activity''

by Frank Gast and Carsten Hiller, Eurex Repo

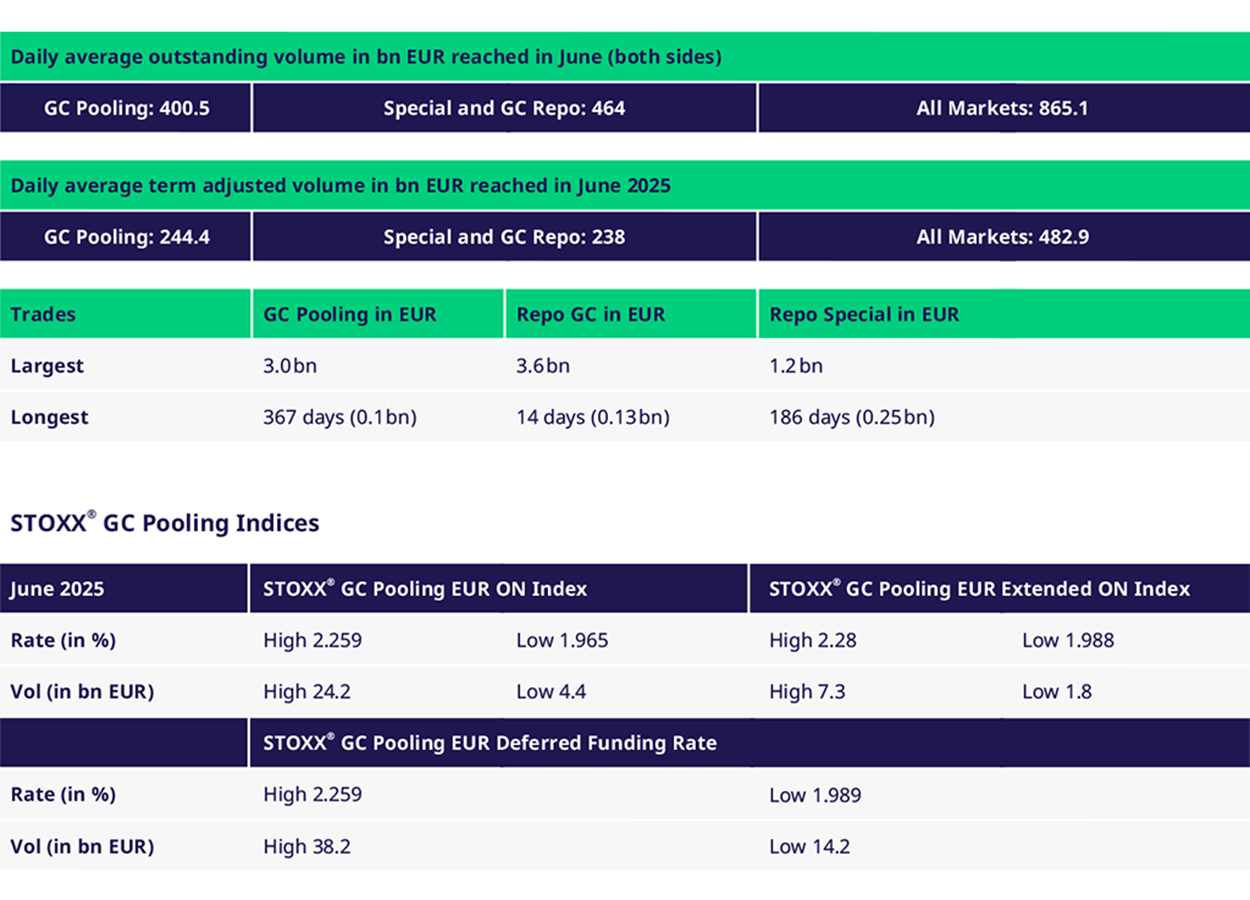

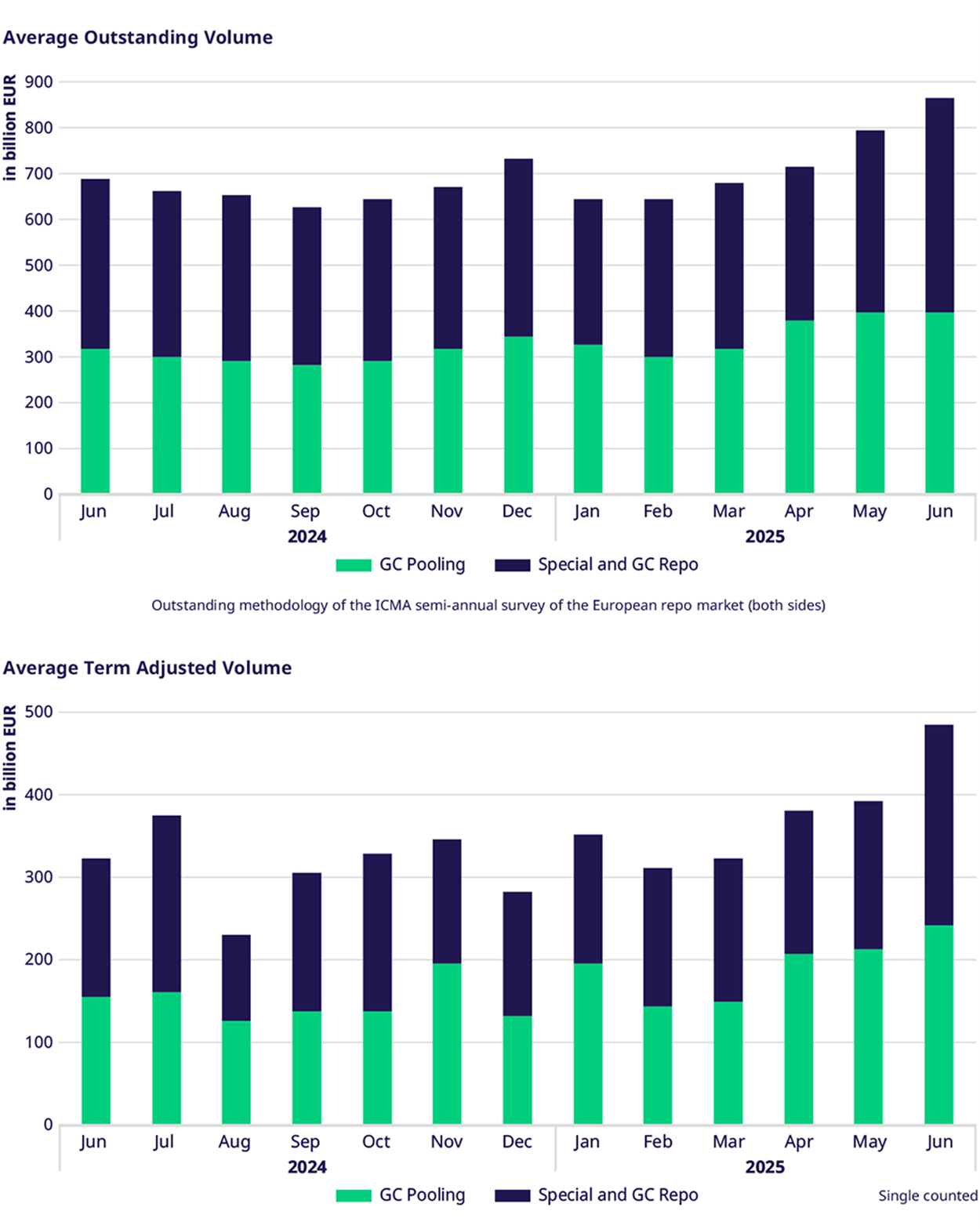

In June 2025, the repo markets experienced a robust rebound in term-adjusted volumes, marking a 49% increase compared to June 2024. This growth was driven by a 56% rise in GC Pooling and a 43% increase in the Repo segment. On a year-over-year basis, the overall market grew by 3%, with GC Pooling up 22% and the Repo segment narrowing its decline to -12% – a notable improvement from May’s -21% y-o-y drop. The ECB’s widely anticipated 25 basis point rate cut on 5 June, which brought the deposit facility rate (DFR) to 2.00% effective 11 June, was smoothly absorbed by the market.

Outstanding and Traded Volumes

Average outstanding volumes across all markets rose by 26% versus June 2024, with GC Pooling and the Repo segment each contributing equally at +27% and +26%, respectively. A new record high in outstanding volume was set on 27 June.

Traded volumes also showed strong momentum. Compared to June 2024, average daily traded volumes increased by 13%, with GC Pooling remaining flat and the Repo segment surging by 32%. On a year-over-year basis, overall traded volumes rose by 4%, with GC Pooling up 9% and the Repo segment down just 2% – a marked recovery from the -8% y-o-y seen in May.

Spreads and Collateral

The spread between the EXT and ECB baskets averaged 1 to 1.5 basis points in June, widening by 0.5 bps from May and peaking at 6 bps over the half-year end. The ECB basket traded 0.3 bps tighter to the DFR at -0.6 bps, while the EXT basket widened to +0.7 bps over DFR.

Half-year end passed smoothly, with overnight GC Pooling in the ECB basket trading around 1.965%, approximately 3 bps lower than previous weeks. The EXT basket traded higher at around 2.025%.

GC Pooling term spreads versus €STR OIS remained stable up to 3 months, with the ECB basket at 11.9 bps and EXT at 13.8 bps. The INT MXQ widened by 3 bps to 13.5 bps. At the 12-month tenor, spreads in the ECB and EXT baskets tightened by 2.5 and 4 bps, respectively, trading near 17-18 bps.

GC & Specials

Bund Special volumes declined by 14% compared to May but increased by 6% versus June 2024, continuing the recovery from the mid-2024 lows. Year-to-date (January to June), Bund volumes are nearly flat compared to last year, whereas Q1 still showed a 7% decline.

Overall traded volumes in Government Bonds (GC & Specials) rose by 17% month-on-month, driven by a 160% surge in French govies and over 40% growth in Spanish and Italian govies.

SSA volumes dipped 7% from May but remain up 89% year-to-date. EU Bonds defied the broader SSA trend, rising 3% month-on-month and maintaining a 119% increase year-to-date.

A notable development was the execution of the first 3-year term transactions – introduced last year as an alternative to expiring TLTROs – on French and Spanish government bonds.

GC Pooling

GC Pooling continued its strong performance, with term-adjusted volumes up 56% versus June 2024 and outstanding volumes up 27%. This was supported by active term trading across the curve up to 12 months, particularly in the ECB and EXT baskets. The INT MXQ basket also saw increased activity, especially in 2- and 3-month terms. Traded volumes across all currencies in GC Pooling rose by 13% compared to June 2024, with 59% in the ECB basket and 38% in the EXT basket. In EUR, 45% of trades were overnight

Volumes

| |||

|

Participants: 167