24 Nov 2025

Eurex

Index Total Return Futures: Introduction of Forward Implied Strategies for Order Book and T7 Trade Entry Service

1. Introduction

As previously announced in Eurex Circular 091/25, Eurex T7 Release 14.0 will introduce Forward Implied Spread (FIS), which allows for trading of calendar spreads strategies with Index Total Return Futures (TRF). The new functionality is aimed at enhancing price transparency and order book liquidity, as well for creating efficient opportunities for hedging and arbitrage.

Calendar strategies were the first type of strategies launched for Index TRFs launched in September 2022 only for Off-Book trading via T7 Trade Entry Service (TES). The new FIS structure for Index TRF is defined as a complex instrument which will allow the expansion of such strategies for Order Book trading as well. The new FIS strategies will eventually supersede the prior approach for calendar spreads in TES after the introduction of the new TRF FIS approach.

Similar to Delta Neutral strategies recently introduced with T7 Release 13.1, four types of FIS calendar strategies will be available for the Order Book and T7 Trade Entry Service (TES) – i.e. Trade-at-Close (TAC) and Trade-at-Market (TAM) handling of Index TRFs with two sub-types (“Fixed” and “Market”).

Production launch: Monday, 24 November 2025

2. Required action

Participants are recommended to completely analyze the potential impact in their internal systems and procedures of the above changes. More details are included in T7 Release 14.0 Final Release Notes which give an overview of all impacted interfaces.

3. Details

From a T7 perspective, the new FIS strategies will replicate the market convention for trading calendar spreads with Index TRFs which entails two legs for the same product code with two different expiries and opposite market side. As an illustration, a Trading Participant acting as a Liquidity Provider may create the following FIS strategy for Index TRF on EURO STOXX 50® (TESX):

- Anchor Leg: TRF shorter dated contract (e.g. TESX Dec-26)

- Negotiable Leg: TRF longer dated contract (e.g. TESX Dec-30).

The individual TRF legs of the strategy will have be priced in outright spreads (TRF Spreads) expressed in basis points in line with the quoting convention for Index TRFs.

From a Trading Participant perspective, the following handling will apply in Order Book upon the creation of the strategy via the T7 Trader GUI for the four categories of FIS strategies:

A. TAM FIS strategies with regular Final TRF trades and custom underlying index level (strike) applicable to both TRF legs:

- Fixed TAM FIS (“FTAM-TF”) – the Trading Participant “fixes” the spread of the Anchor Leg and provide a Bid or Ask spread for the Negotiable Leg.

- Market TAM FIS (“FTAM-TM”) – the Trading Participant provides a Bid or Ask spread for the Negotiable Leg, while the newly created strategy will be marked as “Mkt” in the T7 Trader GUI. Once an incoming order is executed against an existing FTAM-TM strategy, the spread of the Anchor Leg is automatically assigned by T7 based on the market price (e.g. last traded price in orderbook or previous day’s settlement price).

Note: Trading Participants acting as a Liquidity Providers may submit two-way quotes for the Negotiable Leg upon the creation of a new TRF FIS strategy via the T7 Enhanced Trading Interface (ETI).

B. TAC FIS strategies with Preliminary and Final TRF trades based on official index close of the underlying applicable to both TRF legs – similar handling as above will apply for Fixed TAC FIS (“FTAC-TF”) and Market TAC FIS (“FTAC-TM”).

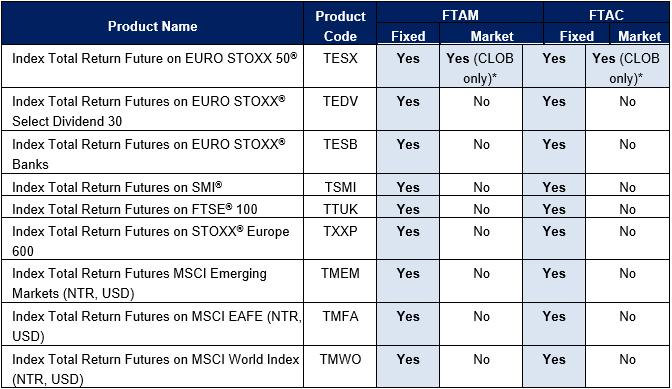

The list of FIS strategies will be implemented for the Index Total Return Futures as follows:

* Available only in Central Limit Order Book (not available for T7 Trade Entry Service Functionality)

Note: the corresponding ratio in all the above will be on a 1:1 basis.

C. Technical Documentation

Eurex T7 Release 14.0 documentation can be found at: Support > Initiatives & Releases > T7 Release 14.0

Further information

Recipients: | All Trading Participants of Eurex Deutschland and Vendors | |

Target groups: | Front Office/Trading, Middle + Backoffice, IT/System Administration, Auditing/Security Coordination | |

Contact: | Stuart Heath, Equity & Index Product Design, tel. +44-207-862-72 53, stuart.heath@eurex.com; Elena Marchidann, Equity & Index Product Design, tel. +44-207-862-72 65, elena.marchidann@eurex.com | |

Related circular: | Eurex Circular 091/25 | |

Web: | ||

Authorized by: | Matthias Graulich |